URGENT UPDATE: The ambitious $36.4 billion takeover bid for Santos has officially collapsed due to critical issues surrounding time, tax liabilities, and due diligence. This shocking development, confirmed by sources close to the matter, raises serious questions about the future of one of Australia’s leading gas companies.

The XRG consortium, composed of investors from the United Arab Emirates, struggled to finalize a binding offer after extending their due diligence period twice. On Wednesday night, they formally withdrew their bid, citing “commercial factors” that made the acquisition too risky at the proposed price of $5.76 (AUD $8.63) per share.

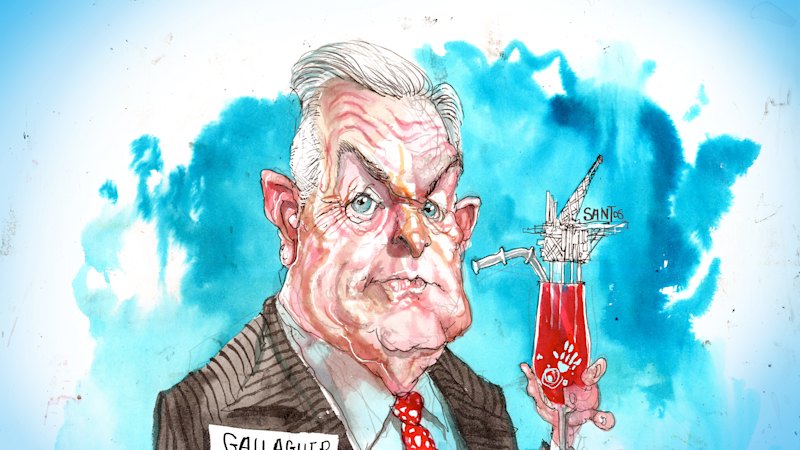

Santos CEO Kevin Gallagher, who has faced substantial pressure from shareholders to improve company performance, must now confront the fallout from this failed bid. Investors were hopeful that this would mark a pivotal moment for Santos, but the collapse leaves the company’s future in limbo.

This bid was supposed to signify a major turning point for Santos, which has long struggled to convert its considerable potential into shareholder value. The failed takeover is particularly disheartening as it marks the third unsuccessful acquisition attempt for Santos within the past seven years—an unprecedented situation among ASX100 companies.

According to insiders, the Santos board pushed XRG for approvals before submitting formal takeover documents and calling a shareholder meeting. This led to concerns over potential delays that could jeopardize the deal, especially given the volatile nature of oil prices and foreign exchange rates. With the oil market facing unpredictable shifts, the timing of the bid became even more precarious.

TIME IS OF THE ESSENCE: The XRG consortium’s bid was initiated three months ago, and concerns had mounted over the possibility of extending negotiations for an additional six to nine months. Investors are now left grappling with uncertainty, as Santos shares are projected to tumble following the announcement, with previous closing prices at $7.65, representing an 11 percent discount to XRG’s offer.

The broader implications of this failed takeover are significant. Santos operates a diverse portfolio that includes both domestic gas and liquefied natural gas (LNG) projects in Australia, Papua New Guinea, and Alaska. However, the company has faced mounting pressures from rising environmental regulations, construction costs, and regulatory hurdles, complicating its operational landscape.

In a challenging environment for the energy sector, Santos’s struggles reflect a global narrative where capital is increasingly difficult to secure. As the cost of doing business escalates, even established companies like Santos and Woodside Energy find it hard to attract investment, currently trading at about five times forecast EBITDA.

What’s next for Santos? As CEO Gallagher prepares to address shareholders on Thursday, he must provide a compelling narrative to restore confidence in the company. With investors growing increasingly impatient, the stakes have never been higher. Santos’s efforts to simplify its operations and enhance shareholder value will be closely monitored.

This developing story underscores the fragility of the energy sector in Australia and the complexities involved in securing large-scale acquisitions. As the situation unfolds, stakeholders will be keen to see how Santos navigates these turbulent waters and what potential buyers might emerge in the future.

Stay tuned for further updates on this breaking news as we continue to follow the aftermath of this significant corporate setback.