Copper prices have experienced a notable increase recently, driven by supply disruptions and a weaker US dollar. These factors have contributed to a short-term upward trend, with rising global demand further supporting this momentum. As the trends toward electrification and green energy intensify, the long-term outlook for copper remains positive.

In recent months, copper prices began to rebound, particularly in October, following a significant decline at the end of July when former President Donald Trump unexpectedly exempted raw copper materials from tariffs. Prior to this decision, US copper imports surged, causing prices to exceed global benchmarks and pushing inventories to a 21-year high. However, the subsequent price drop and ongoing supply issues at some of the world’s largest copper mines have slowed trading activity in recent weeks.

Supply Challenges Keep Prices Elevated

Concerns surrounding supply have been a key driver of copper prices. The market’s response to production outages resembles that of crude oil, where interruptions typically lead to sharp price increases. Recent disruptions at the Grasberg Mine in Indonesia, the second-largest copper mine globally, prompted Freeport-McMoRan Inc. to declare force majeure last month after heavy flooding compromised underground operations. Tragically, investigations revealed that all five missing workers were found deceased. Consequently, the company has revised its production forecasts downward.

Copper futures traded in London have approached highs not seen since May 2022, when prices peaked at $10,915 per tonne. This upward trend reflects both immediate supply issues and the broader shift towards sustainable energy solutions.

Broader Metal Market Dynamics

Copper is not the only metal experiencing gains; other base and precious metals, including aluminium and platinum, have also seen upward movements. Notably, gold has reached new heights, nearing the $4,000 mark, while silver approaches its 2011 peak near $50. The current uptick in gold prices is attributed not only to speculation but also to several robust market trends.

The declining strength of the US dollar has further bolstered copper’s recent performance. The greenback has faced significant challenges this year, marking one of its weakest periods since the early 2000s. Recent losses have been exacerbated by a government shutdown, while fluctuations in the euro and Japanese yen have provided temporary relief for the US currency.

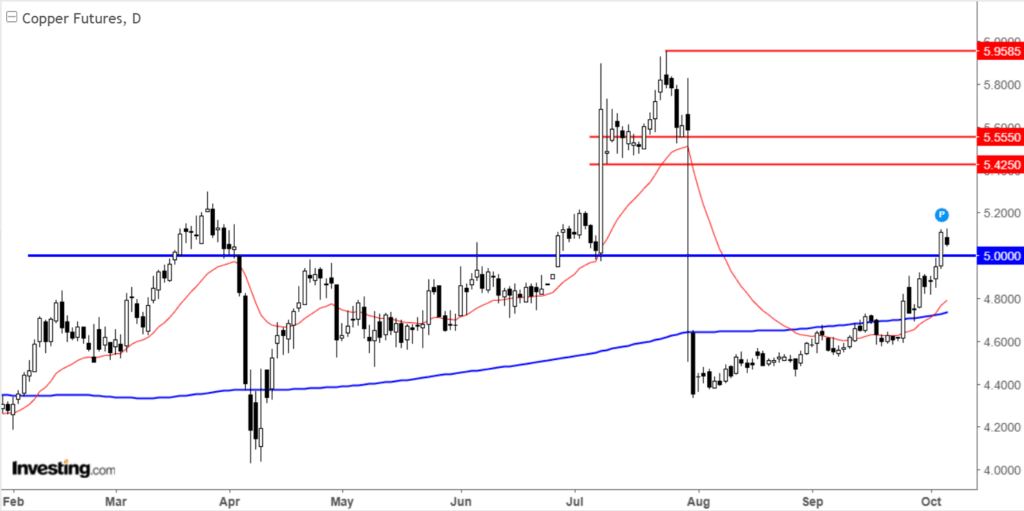

Technical analysis indicates a resumed upward trend for copper, as the 21-day exponential moving average has crossed above the 200-day simple moving average. This development suggests that dip-buying could be a favorable strategy for investors. Key support now lies at the reclaimed $5,000 level, a psychological barrier that, when maintained, could signal further upward movement. The next targets for traders are around $5,425 and $5,555, with an eye on this year’s peak of $5,958.50.

Long-term, the macroeconomic backdrop remains bullish for copper. The global shift towards electrification is accelerating as industries replace fossil fuel-based systems with electric alternatives. Electric vehicles, in particular, are driving significant demand for copper, especially in major economies like the US and China. Beyond transportation, copper is integral to electrical wiring, plumbing, and construction.

Investors looking to navigate the current market landscape may find resources such as InvestingPro useful. The platform offers a suite of tools designed to assist in making informed investment decisions, including AI-managed stock strategies and comprehensive financial data.

As the market evolves, the interplay of supply disruptions, currency fluctuations, and global demand for copper will continue to shape its price trajectory. The outlook for copper remains optimistic, underpinned by fundamental shifts toward sustainability and electrification.