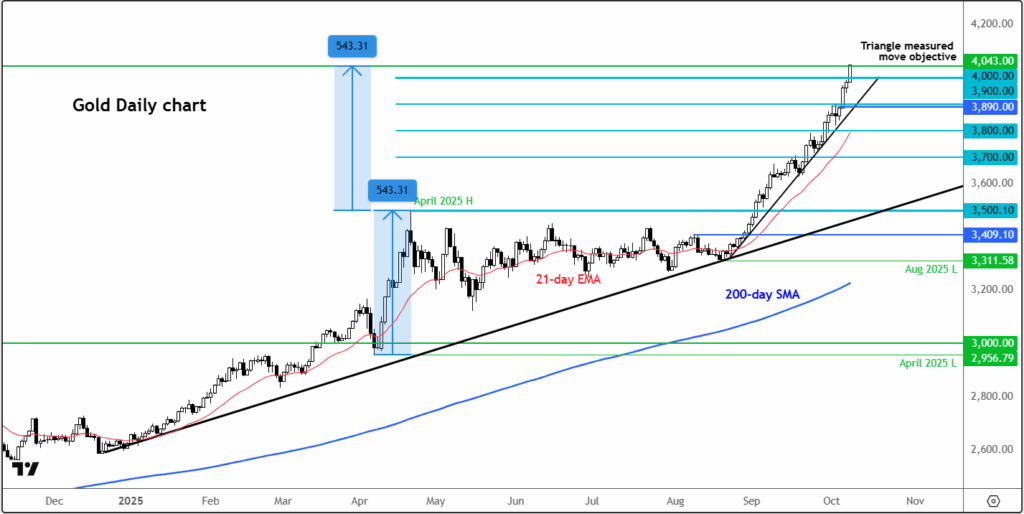

Gold prices have reached a historic milestone, surpassing $4,000 per ounce for the first time in history. This surge comes amid ongoing political instability in the United States and escalating tensions in Europe. Analysts at Goldman Sachs have raised their price target for gold to $4,900 by 2026, signaling continued optimism for the precious metal’s performance.

The catalyst for gold’s recent ascent is multifaceted. The ongoing government shutdown in the United States has heightened uncertainty, while unrest in France adds to the global political climate that often drives investors towards safe-haven assets. Spot gold prices climbed an additional $40 to reach a new high of $4,040, reflecting a growing demand for stability amid chaos.

Political Unrest Fuels Gold Demand

The US government shutdown has entered its second week without signs of resolution, with critical paychecks due for government workers and military personnel on October 10 and October 15, respectively. Should these payments be missed, market anxiety could escalate significantly.

In Europe, political turmoil has also unsettled investors. The crisis in France adds a layer of complexity to already strained economic conditions, leading traders to seek refuge in gold. Despite the resilience of stock markets—which have seen the S&P 500 futures rebound—gold has benefitted from haven flows, underscoring its role as a defensive asset during times of uncertainty.

Economic Indicators and Central Bank Actions

Recent economic data from Germany raised alarms as industrial production fell by 4.3% month-on-month, suggesting a potential recession in the Eurozone’s largest economy. Meanwhile, in the United States, key economic indicators have been inconsistent, particularly in employment, further complicated by the government shutdown.

The Federal Reserve faces the challenge of making policy decisions without timely data, forcing them to rely on previous signals of potential rate cuts. Futures markets are currently pricing in a 25-basis-point rate cut this month, which bolsters the appeal of non-yielding assets like gold.

Investor appetite for gold remains robust. Gold-backed exchange-traded funds (ETFs) have experienced significant inflows, pushing total holdings to their highest levels since September 2022. This trend indicates sustained demand and reflects a strategic shift among global central banks, including the People’s Bank of China, which has increased its gold purchases for the eleventh consecutive month, undeterred by rising prices.

The outlook for gold remains predominantly bullish, although potential headwinds exist. A slowdown in central bank purchases or a reduction in geopolitical tensions could diminish gold’s appeal. Nevertheless, current momentum and macroeconomic factors suggest that traders are likely to continue their bullish strategies, particularly in the face of ongoing uncertainty.

As gold has now broken through the $4,000 threshold, bullish traders have achieved key objectives, with targets extending to around $4,100 and $4,200. Initial support is now established at $4,000, followed by a trend line and $3,900.

The recent surge in gold prices reflects not just a defensive reaction to current events but also speculative trading as investors anticipate future moves by central banks. With substantial macroeconomic forces at play, the gold market is poised for further developments as economic and political landscapes evolve.