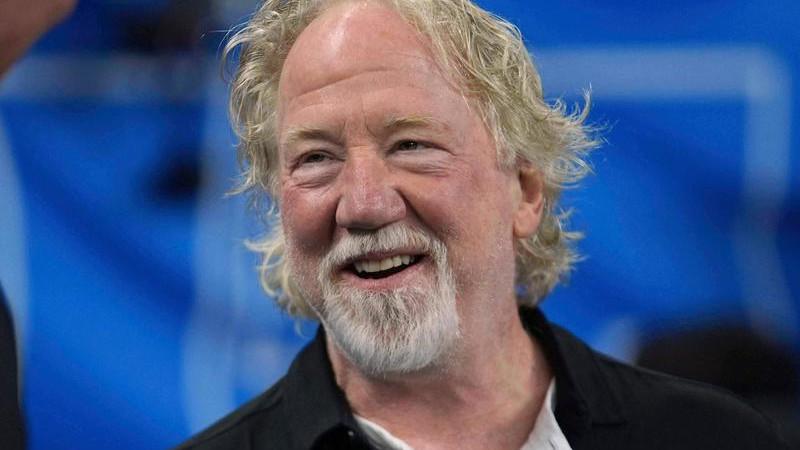

Diggers & Dealers conference in Kalgoorlie. Luke Tonkin MD of Silver Lake resources. Picture by Sharon Smith The West Australian 2 August 2016

UPDATE: Vault Minerals shareholders have delivered a powerful rebuke against executive pay, casting 52% of votes against the company’s remuneration report during its annual general meeting on November 24, 2023. This significant backlash marks the first strike under the Corporations Act, raising alarms over the payout packages for outgoing CEO Luke Tonkin and former COO Richard Hay.

The influential proxy advisory firm Institutional Shareholder Services (ISS) recommended that clients oppose the remuneration report, targeting Tonkin’s 5.1 million long-term performance rights, valued at over $1.7 million when granted last year. These rights are set to vest as long as Tonkin remains in his position until February 1, 2026, despite his announcement in August of an impending departure within the next year. Shareholders are now concerned that this arrangement could allow Tonkin to fully benefit from the performance rights without fulfilling the intended vesting conditions.

In a statement, ISS expressed serious concerns about the implications of these payouts.

“Full vesting of award upon cessation of employment is considered problematic and materially inconsistent with local market standards,”

the firm noted, emphasizing that such arrangements should ideally incorporate forfeiture of unvested awards or pro-rata vesting based on performance.

Moreover, Richard Hay, who ended his tenure as COO on November 26, 2022, received a termination payout exceeding $517,000. This payout includes cash in lieu of a contractual notice period and retention rights that he was entitled to but not issued before his departure. While ISS stated that the total amount was not excessive, they highlighted potential shareholder concerns regarding his retention rights, which had been granted just days before his exit.

Vault Minerals has experienced a remarkable surge, with shares rising approximately 128% in 2025 amid a booming gold market, pushing the company’s market capitalization above $5 billion last month. However, the current discontent among shareholders poses a significant challenge for the company’s leadership.

Looking ahead, if Vault faces another strike against its remuneration report in the following year, shareholders will be compelled to vote on whether to convene a meeting to potentially spill the board. Historically, such proposals rarely receive favorable votes, even in instances of multiple pay strikes.

As the situation develops, shareholders and market analysts will be closely monitoring the impact of this decision on Vault’s governance and future performance.