URGENT UPDATE: As the property market heats up, potential homebuyers are urged to pause and reassess their readiness. Experts warn that jumping into a $500,000 mortgage without proper preparation can lead to devastating financial mistakes.

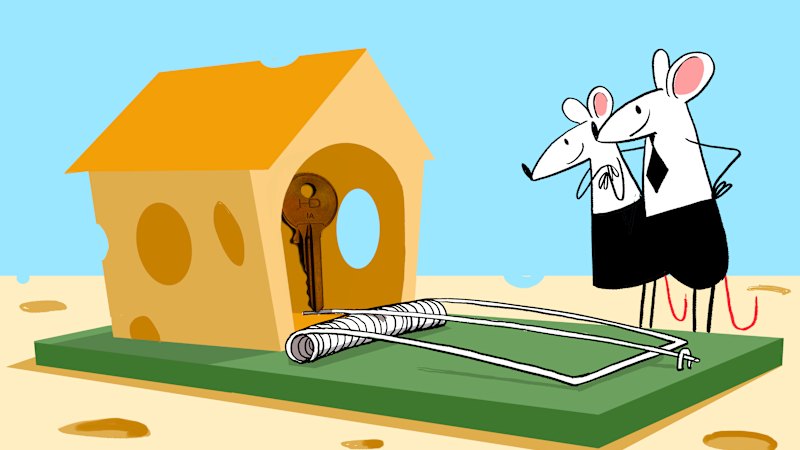

In a rapidly changing real estate landscape, Paridhi Jain, founder of SkilledSmart, emphasizes the importance of understanding your financial health before making such a significant investment. “Property investing might seem appealing,” Jain states, “but it can easily turn into a trap if you’re not fully prepared.”

Recent discussions reveal that many prospective buyers fall into the common pitfalls of property investment. The complexity of real estate transactions — involving banks, brokers, and builders — can amplify small mistakes into significant losses. Jain notes, “When you’re signing for a half-a-million-dollar property, every detail is magnified.”

The urgency to buy can cloud judgment, with many feeling pressured to secure a home in the current market. This mindset often leads to financial strain, as buyers may underestimate ongoing costs and maintenance. Jain warns, “People often assume property is safer than shares, but this is a misconception.”

Here are three critical signs that indicate you might not be ready to buy property:

1. **Gaps in Financial Knowledge**: If your finances feel disorganized and you lack clarity on key aspects like superannuation or taxes, it’s crucial to seek guidance before committing to a mortgage.

2. **Fear of Alternatives**: If you’re hesitant to invest in simpler options like ETFs but are ready to dive into a large mortgage, reconsider your approach. Building confidence with smaller investments can provide clarity and choice.

3. **No Wealth-Building Strategy**: Without a clear plan for building wealth outside of homeownership, you risk pouring all your resources into an overly ambitious property purchase. Jain advises that true financial security comes from diversifying investments, not just focusing on real estate.

Jain emphasizes that understanding the basics of financial health is essential. “When you take on a half-a-million-dollar mortgage, you need to be ready both financially and emotionally,” she urges. “Avoid rushing into a decision out of fear or pressure.”

As the housing market evolves, potential buyers are urged to take a step back, assess their overall financial strategy, and ensure they are making informed choices. The latest insights from SkilledSmart urge consumers to prioritize education and financial literacy before entering the property market.

Stay informed with expert tips on how to save, invest, and optimize your financial future by subscribing to the Real Money newsletter, delivered every Sunday. Don’t make an impulsive decision that could affect your financial well-being for years to come.