UPDATE: The Australian Tax Office (ATO) has confirmed a significant focus on tax compliance, making it the most-read topic among SmartCompany readers in 2025. As businesses brace for intensified scrutiny, taxpayers are increasingly aware of ATO’s strategies, including a detailed hit list targeting specific industries.

Just hours ago, the ATO revealed crucial benchmarks used to identify cash jobs and fraudulent deductions. This information is vital for small businesses and entrepreneurs looking to navigate the complex tax landscape. The urgency is palpable as taxpayers receive “threatening” letters from the ATO, prompting concern regarding potential penalties for non-compliance.

Among the top stories, Jason Andrew’s shocking account of receiving $20,000 from the ATO for doing nothing sparked widespread discussion and disbelief. This unusual case highlights the pressing issues within the tax system and the ATO’s controversial practices, making it one of the year’s standout articles.

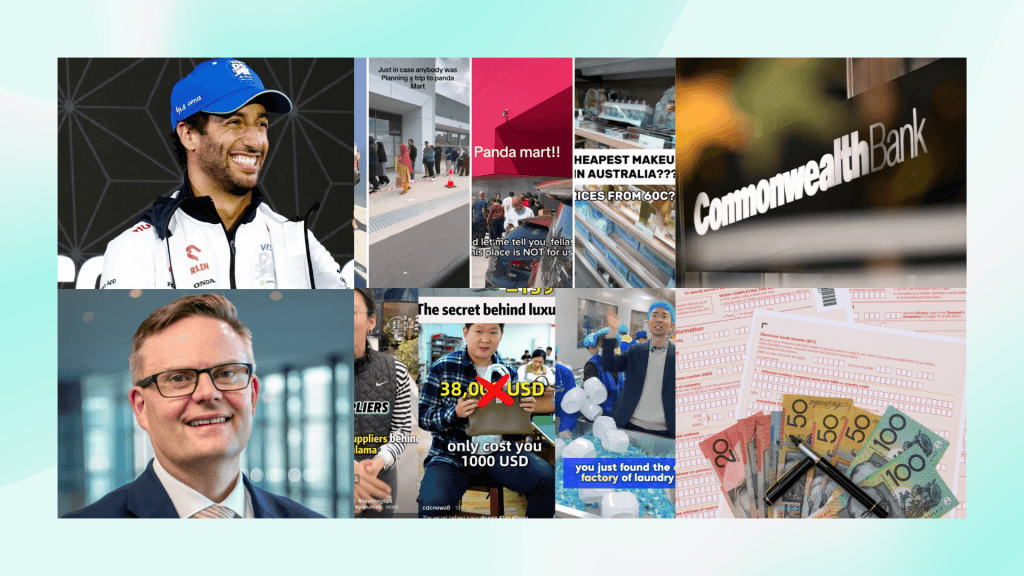

In addition to tax-related news, SmartCompany’s audience showed a keen interest in non-tax topics. Notably, a viral exposé by Chinese manufacturers on TikTok, revealing the inflated costs of luxury items, captivated readers. The article not only showcased the impact of social media on consumer awareness but also raised questions about pricing transparency in global markets.

The Commonwealth Bank (CBA) faced backlash after an internal error involving ChatGPT led to customer complaints being mistakenly directed to the wrong small business. This incident underscores the potential pitfalls of integrating artificial intelligence into customer service without proper safeguards.

As the ATO prepares for a significant policy shift, small businesses are urged to transition from the now-defunct free super clearing house. The deadline for this change is fast approaching, making it crucial for affected taxpayers to act immediately.

In the backdrop of these developments, the ATO reported a steep rise in tax lodgments, with a striking increase noted on July 1, 2025. This surge comes despite the ATO’s pleas for taxpayers to delay submissions, reflecting growing urgency among businesses to comply with tax obligations.

The ATO’s oversight body has also recommended an overhaul of its communication strategies, particularly regarding the intimidating letters sent to taxpayers. As these changes take effect, the implications for business owners could be profound.

Looking ahead, experts anticipate further announcements from the ATO that may redefine compliance standards for the Australian business landscape. Taxpayers and entrepreneurs must remain vigilant as new guidelines could emerge at any moment.

Stay informed on this developing story. Sign up for SmartCompany’s free daily newsletter for the latest updates and insights directly to your inbox.