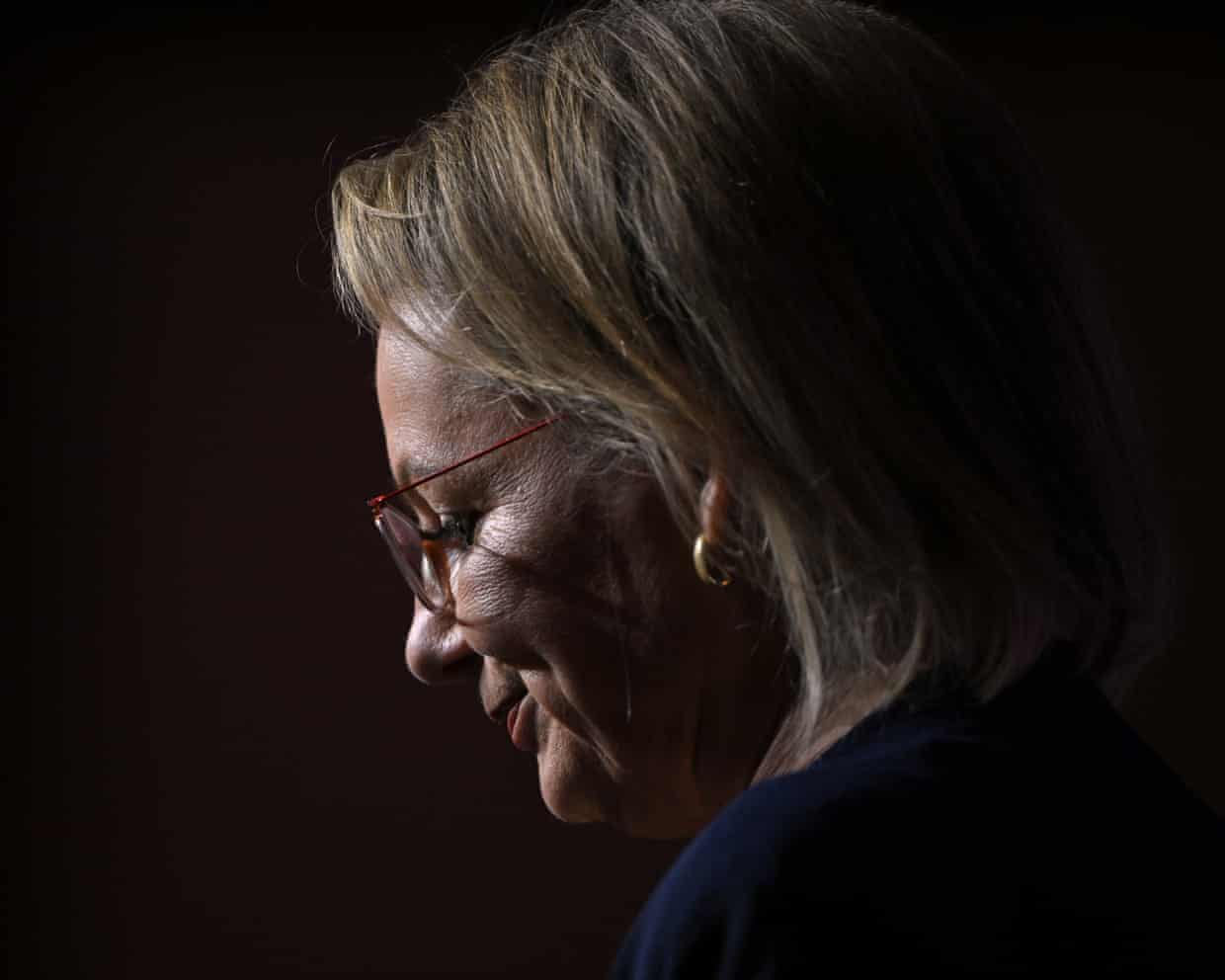

An autonomous haul truck dumps a load of rock in the mine pit at Rio Tinto Group's Gudai-Darri iron ore mine in the Pilbara region of Western Australia, Australia, on Thursday, Oct. 19, 2023. Rio Tinto is preparing for trials of battery-powered locomotives in Australia, where it uses giant autonomous trains ? the world?s largest and longest robots ? to transport iron ore across the vast Outback. Photographer: Carla Gottgens/Bloomberg

The outlook for Western Australia’s mining industry in 2026 presents a mix of challenges and opportunities, particularly for key commodities such as iron ore, gold, rare earths, and lithium. After a year of surprising performance, industry analysts are closely monitoring market dynamics that could shape the future of this vital sector.

Iron Ore: A Potential Downturn Ahead

Iron ore remains the cornerstone of Australia’s mining sector, primarily extracted from the Pilbara region. This key ingredient for steel production generates over $100 billion annually in export income and contributes more than $8.5 billion in royalties to Western Australia. The price fluctuations in iron ore are critical, influencing budget surpluses or deficits for both state and federal governments.

Despite earlier predictions suggesting a decline in iron ore prices to approximately $80 per tonne in 2025, the market surprised many by averaging around $103 per tonne throughout the year. Currently, prices are hovering near $104 per tonne. Economists are now forecasting a downward trend in 2026, with expectations that prices may dip below $100 per tonne.

Contributing factors include the recent export of maiden iron ore from the Simandou mine in West Africa, which is set to add significant supply to the global market. Additionally, China, the world’s largest consumer of iron ore, is experiencing economic challenges that could further suppress demand. Compounding these issues is an ongoing contract dispute between BHP and China’s primary iron ore buyer, which is seeking larger discounts on its purchases.

Gold: Continuing Its Record Surge

In stark contrast, gold has enjoyed a remarkable year, with prices soaring. In March, gold reached a historic milestone by surpassing $3,000 per ounce, eventually climbing to exceed $4,450 per ounce. Many analysts predict that the price could breach the $5,000 threshold in 2026, fueled by geopolitical tensions and increasing demand for safe-haven assets.

Market dynamics surrounding gold have been influenced by various factors, including political events in the United States, which have heightened interest in gold as a secure investment. Kenneth Wan, a portfolio manager at Drummond Knight Asset Management, noted that bull markets for gold typically last between five to seven years, and the current bull market is only about three years old. Even if prices were to drop, most gold miners in Western Australia could still operate profitably, with a buffer of up to $1,000 per ounce.

Rare Earths: Strategic Importance Amid Challenges

Rare earth elements have become increasingly significant, not only for their industrial applications but also due to their military uses. These 17 elements are essential for producing advanced technologies, including fighter jets and laser-guided missiles. China’s near-total control over the global supply chain puts it in a powerful position amidst ongoing trade tensions with the US.

In response, the US and the Albanese Government have recently established a multi-billion-dollar agreement to develop rare earth mines and refineries in Australia. This initiative is expected to attract substantial investment into the sector, as both public and private funds are directed toward enhancing local supply chains. However, challenges remain, particularly regarding the availability of mining and refining equipment, much of which is sourced from China. The potential for significant cost increases in developing rare earth projects is a concern for Australian miners.

Lithium: A Volatile Market Landscape

The lithium market has experienced significant fluctuations throughout the year. The price for spodumene concentrate began at approximately $820 per tonne, dipped below $600 by mid-year, and then surged to over $1,200 per tonne by year’s end. Analysts indicate that around $1,000 per tonne is the benchmark for profitability within Western Australia’s lithium industry.

The price increases in the latter half of 2025 were driven by China’s regulatory changes, which led to the revocation of several mining permits, alongside a rising demand for lithium in energy storage solutions such as the Tesla Powerwall. As the largest Chinese lithium mine involved in this regulatory shift is expected to resume operations soon, analysts remain divided on whether increased output from China will outweigh growing global demand for energy storage solutions in 2026.

The year ahead promises to be pivotal for Western Australia’s mining industry, with each sector facing its own set of challenges and opportunities that will shape its future trajectory.