UPDATE: Australia faces an urgent economic crisis as the gap between asset-rich ‘owners’ and struggling ‘earners’ widens dramatically. Today, February 10, 2026, experts warn that without immediate tax reforms, the country’s economy could face dire consequences.

New reports indicate that while owners experience soaring asset values, earners are grappling with skyrocketing inflation, record rents, and escalating interest rates imposed by the Reserve Bank of Australia (RBA). This disparity has created a troubling K-shaped economy, where the wealthy pull away from those relying on wages.

As a member of the affected earners, I feel the financial strain firsthand. With a new mortgage and a young family, the RBA’s interest rate hikes have made it increasingly difficult to manage our household budget. Recent statements from the RBA suggest that interest rates may need to rise again due to “excess demand” in the economy, further punishing families like mine.

The heart of the issue lies in the stark contrast between the two groups. While owners continue to accumulate wealth, young families and small business owners face financial turmoil. Historically, such economic divisions have been rare; in the past, when housing was affordable, there was a stronger sense of economic mobility. Now, data shows that the net wealth of Australians aged 15 to 44 has declined, while older demographics see their wealth grow significantly.

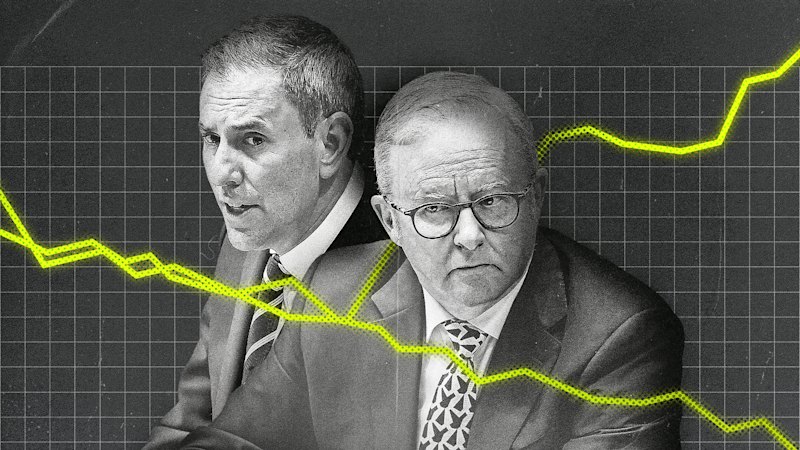

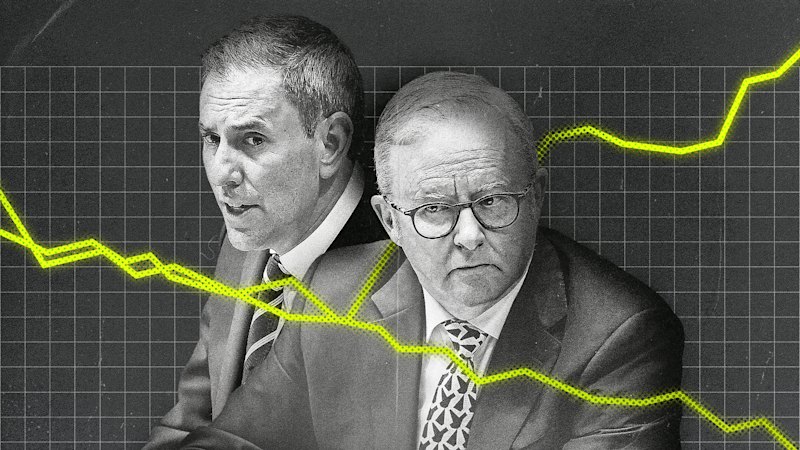

The growing frustration is directed not at the RBA, but at politicians who have failed to address the root causes of this inequality. Prime Minister Anthony Albanese and Treasurer Jim Chalmers are urged to take decisive action and reform the tax system. By adjusting tax breaks like the capital gains tax discount, policymakers can reduce inflationary pressures and promote a more equitable society.

Failure to act risks further eroding financial security, leading to a society where young Australians struggle to invest in their futures—whether in education, entrepreneurship, or starting families. The current trajectory could culminate in a significant economic downturn, leaving millions unemployed and assets devalued.

The good news? History shows that political leaders have successfully tackled wealth inequality before. Post-World War II reforms laid the groundwork for decades of prosperity. Now, the call for a renewed commitment to tax reform is louder than ever.

As the situation develops, citizens are encouraged to engage with their political representatives and demand action on these pressing issues. Anything less than a comprehensive overhaul of the tax system could lead to long-lasting economic mismanagement, jeopardizing the very foundation of the Australian dream.

Stay tuned for further updates on this critical issue affecting millions across the nation.