Australia faces a stark economic divide, with the asset-rich benefiting from rising values while working earners confront escalating costs. The situation has prompted calls for urgent tax reform to address these disparities, particularly as inflation and interest rates rise.

Recent observations indicate a growing gap between two groups within the Australian economy: the “owners,” who have seen their asset values soar, and the “earners,” who depend on wages to make ends meet. This division resembles a K-shape, with the owners thriving while earners struggle under the weight of inflation, record rents, and increasing taxes.

As someone navigating the challenges of a new mortgage and a young family, I find myself among the millions of Australians closely monitoring decisions made by the Reserve Bank of Australia (RBA). Each interest rate cut previously provided a glimmer of hope for improving family finances. Nonetheless, indications of “excess demand” suggest that rates may need to rise again, further burdening those who can least afford it.

The current economic landscape reveals that the spending habits of asset owners are exacerbating the difficulties faced by earners. Historically, low interest rates fueled a boom in property investments, shares, and retirement accounts. However, when the RBA raised rates to combat inflation, it was primarily earners, such as young families and small business owners, who suffered the consequences.

In 2026, any further increases in interest rates could deepen the crisis for earners, while asset owners, with their financial cushions, continue to thrive. Some might argue this cycle is not new, recalling the high interest rates of the late 1980s. Yet, the current lack of affordable housing has stifled economic mobility, transforming what was once a U-shaped economic experience into a K-shaped one that reflects generational disparities.

Data shows that prior to the pandemic, the net wealth of Australians aged 15 to 44 was declining, while older demographics saw significant increases in wealth. Spending patterns since then reveal a troubling trend: as interest rates climbed, older Australians ramped up their spending, while younger Australians were forced to cut back.

While frustration with the RBA is understandable, the reality is that the central bank lacks the tools to address the inflation caused by the asset owners’ actions. The true responsibility for the current economic structure falls to politicians, who have contributed to this situation through years of inadequate policy-making and a reluctance to take action.

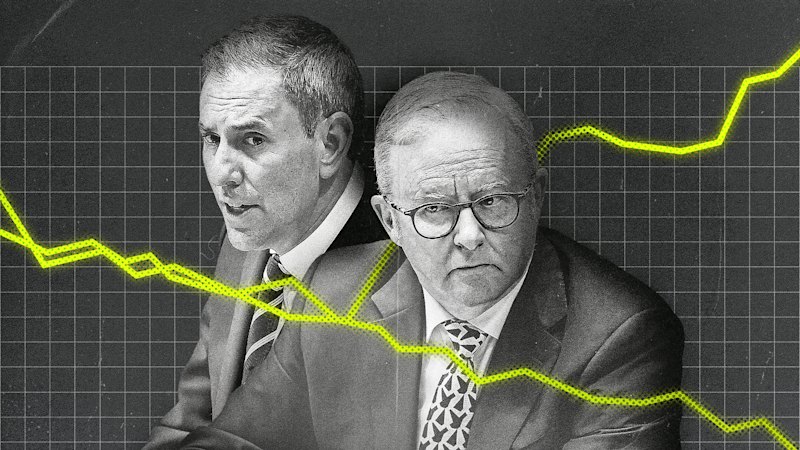

Prime Minister Anthony Albanese and Treasurer Jim Chalmers are urged to take decisive action by reforming Australia’s tax system. Effective tax reform could specifically target those driving inflation, aiming to reverse the splintering of society caused by economic inequality. By addressing overly generous tax breaks, such as the capital gains tax discount and superannuation concessions, the government could shift the burden away from earners and create a more balanced economic environment.

Maintaining support for the spending of asset owners is no longer sustainable. The decline of financial security and economic mobility threatens the very foundation of a fair and merit-based society. Young Australians are increasingly finding it difficult to invest in education, start businesses, or raise families due to financial constraints.

If current tax policies continue, the economy risks stagnation, becoming heavily reliant on a diminishing pool of wealthy investors, older consumers, and family inheritances. Such a scenario could lead to widespread unemployment and a significant decline in asset values.

Historically, political leaders have successfully addressed wealth inequality, particularly with reforms following the Second World War that facilitated decades of broad-based prosperity. However, achieving similar outcomes today requires a commitment to overhauling the tax system. Without this reform, the ongoing economic mismanagement will rest squarely on the shoulders of political leaders, while the RBA bears the brunt of public dissatisfaction.

In summary, the need for urgent and effective tax reform is evident. The future of economic mobility and fairness in Australia depends on the actions of its leaders, who must prioritize the well-being of all citizens over the interests of a privileged few.