The Albanese government is significantly lagging behind its goal of constructing 1.2 million new homes by the end of the decade, with recent data indicating a shortfall of more than 70,000 homes. This comes as the total wealth of Australians from existing residential properties has soared to nearly $12 trillion, driven by escalating property values.

Despite efforts to expedite land development processes previously hindered by environmental regulations, the Australian Bureau of Statistics reported a 6.4 percent decline in dwelling approvals for October. This downturn is particularly concerning as it contradicts the government’s housing targets during a time of rising real estate prices.

Declining Approvals and Rising Prices

The property sector has identified approvals for units as critical to meeting housing targets. However, approvals dropped 13.1 percent in October, following a substantial 25 percent increase in September. Additionally, approvals for standalone homes saw a slight reduction of 2.1 percent in the same month.

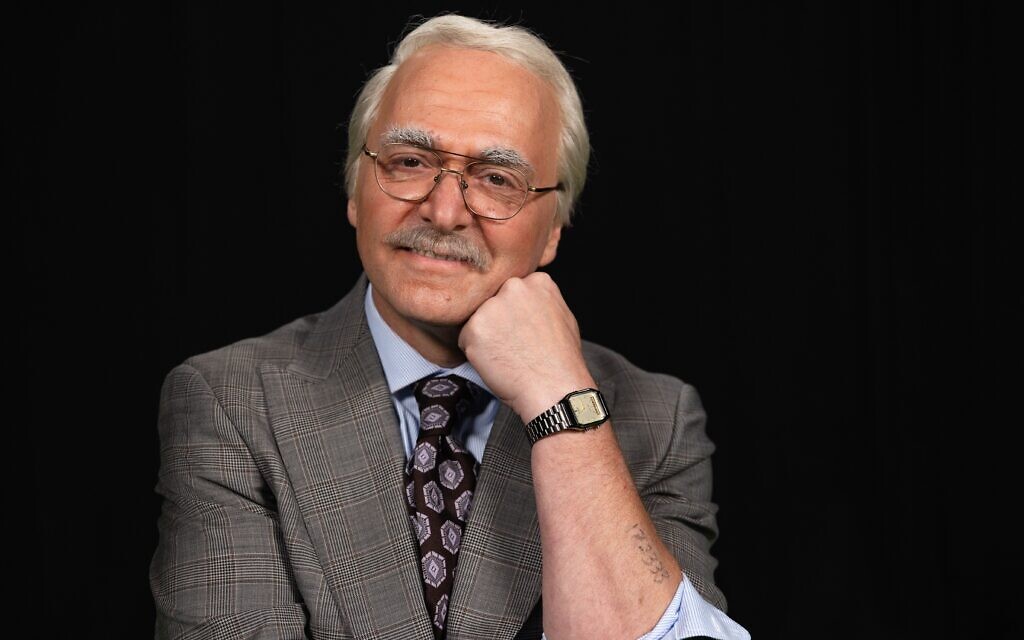

According to Shane Garrett, chief economist at Master Builders Australia, 255,000 new homes must be constructed annually over the next four years to align with government objectives. Yet, in the year leading up to October, only 192,000 homes were completed.

Garrett emphasized the urgency of addressing the housing affordability crisis, stating, “Housing affordability has recently deteriorated to its worst on record. Our failure to build enough new homes will exacerbate this situation further.”

The seriousness of this affordability issue is underscored by ABS statistics revealing that the value of residential properties surged by $317 billion in the September quarter, translating to approximately $3.4 billion daily. Over the past year, the total value of the nation’s 11.4 million residential properties increased by $875 billion, nearing the $12 trillion mark.

The median price of established homes in Sydney has reached $1.46 million, while both Brisbane and Canberra reported median prices exceeding $1 million. Moreover, unit prices in Brisbane, Adelaide, and Perth have all risen by more than 10 percent in the last year.

Challenges in Meeting Housing Targets

While Melbourne’s median house price saw only a marginal increase to $828,000, the state of Victoria has been leading the way in home supply, adding 153,100 new residential properties over the past three years. In contrast, New South Wales and Queensland recorded increases of 130,700 and 101,000 homes, respectively.

Matthew Kandelaars, a senior official with the Property Council, highlighted the necessity of approving large-scale apartment projects to meet housing goals and curb price inflation. “Today’s data shows complex and rigid planning systems continue to hold us back. We need wholesale reform and an unfailing focus on structural improvements to approvals processes,” he remarked.

In a bid to alleviate the housing crisis, the government has set a target to expedite environmental approvals for 26,000 homes by July next year. Progress is being made, with land for 14,000 homes officially approved under federal environmental law as of last week. Notably, a site on the NSW South Coast near Batemans Bay has received approval for 741 homes following a 62-business-day assessment.

Environment Minister Murray Watt expressed optimism about the housing outlook, stating, “We are rocketing toward our goal of fast-tracking the assessment of the 26,000 housing projects in the pipeline by July next year.”

However, the potential for future approvals may be influenced by the interest rate policies of the Reserve Bank of Australia. The ANZ, the nation’s fourth-largest bank, recently indicated expectations for an interest rate cut in the first half of next year.

Adam Boyton, ANZ’s head of Australian economics, noted that if inflation remains persistently high and unemployment steady, the Reserve Bank might need to raise interest rates. Conversely, the absence of further rate cuts could dampen household spending and consumer sentiment, impacting business conditions and GDP growth.

Looking ahead, the upcoming national accounts for the September quarter are anticipated to reflect a rise in GDP growth, with expectations of a 0.7 percent increase driven by heightened government expenditure and consumer activity. If realized, this would push annual growth to 2.2 percent, marking the fastest pace in two years and exceeding the Reserve Bank’s forecasts.

As the government navigates these challenges, the interplay of housing supply, affordability, and economic conditions will remain critical for the future of Australia’s residential market.