Anteris Technologies, a heart medtech company backed by L1 Capital and the New York-based hedge fund Sio Partners, successfully secured approximately $38.5 million through a recent capital raising initiative. The fundraising, which commenced on September 29, 2023, was initially targeted at $30 million to support the company’s clinical strategy but was expanded in response to high demand from investors.

The newly issued chess depositary interests were offered at $7.50 per share, representing a discount of 14.8 percent from Anteris’ last closing price. The capital raise was managed exclusively by Evolution Capital, according to details from the term sheet.

Innovative Heart Valve Technology Under Trial

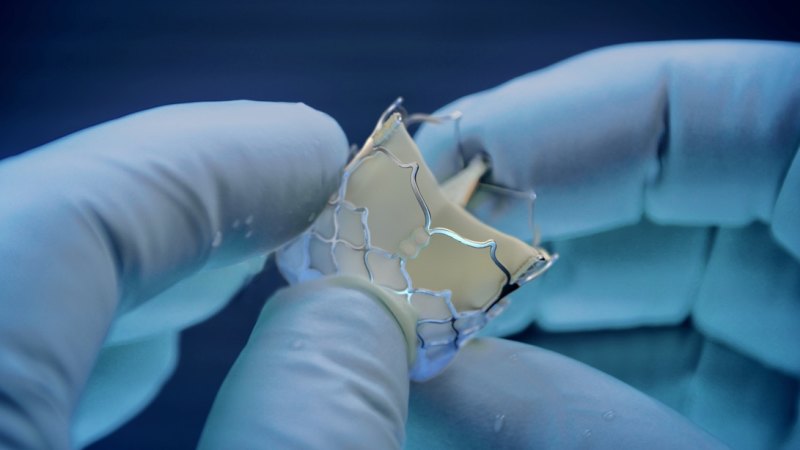

Anteris Technologies, which operates with a market capitalization of $317 million, is currently advancing its flagship heart valve innovation, the DurAVR system. This technology aims to replicate the functionality of a healthy human aortic valve and is designed for patients suffering from aortic stenosis, a condition characterized by the narrowing of the valve that limits blood flow.

Founded in Australia and now headquartered in Minneapolis, Anteris has been conducting human trials of its DurAVR prosthetic aortic valve since 2021. As of now, the company has successfully treated 130 patients with this device.

Despite experiencing a setback in September 2023 when it was removed from the All Ordinaries Index due to quarterly rebalancing, Anteris has seen a positive shift in its stock performance recently. Over the past year, the company’s shares have decreased by 22 percent, but they have gained traction in recent months following several key announcements.

Strategic Partnerships and Upcoming Trials

The renewed interest in Anteris can be attributed to a range of significant developments, including a testing and manufacturing agreement with Switchback Medical. The company also reported its quarterly results and provided updates regarding its pivotal Paradigm trial, which is set to commence in October 2023.

As Anteris Technologies continues to advance its clinical strategies and expand its market presence, the recent capital infusion will likely play a crucial role in the ongoing development of its innovative heart valve technology. The company’s commitment to addressing aortic stenosis through its advanced solutions positions it as a notable player in the heart medtech field, attracting both investor confidence and patient interest.