Australian investors increasingly embraced exchange-traded funds (ETFs) in 2025, resulting in a significant influx of capital into this investment vehicle. According to data from Betashares, net investments in ETFs reached $53 billion, a remarkable 75% increase compared to 2024. This shift reflects growing confidence in ETFs as a means for diversification and cost-effective investing.

Outstanding Performers in the ASX ETF Landscape

Three ETFs, in particular, stood out for their impressive returns last year.

The Global X Copper Miners ETF (ASX: WIRE) led the pack with a staggering return of 93%, closing the year at $22.20 per share. This ETF has thrived due to surging global demand for copper, crucial for electrification and the transition to green energy. Over the past year, copper prices soared 42%, reaching a record high of over US$6 per pound. WIRE aims to track the performance of the Solactive Global Copper Miners Total Return Index and holds a diversified portfolio of 39 stocks. Notably, investments are geographically diverse, with 37% in Canada, 11% in the United States, and 10% in Australia, among others. The ETF includes significant holdings such as Sandfire Resources Ltd (ASX: SFR) at 3.2% and BHP Group Ltd (ASX: BHP), the world’s largest copper producer, comprising 4% of the fund.

Another notable performer is the Vaneck Global Defence ETF (ASX: DFND), which achieved a return of 57% in 2025, closing at $36.74. The DFND ETF tracks the MarketVector Global Defence Industry (AUD) Index and includes 36 shares. Its leading holding is Thales SA (FRA: CSF), a French company specializing in defence electronics. Other key investments include RTX Corp (NYSE: RTX) and Leonardo Spa (FRA: FMNB), both prominent players in the aerospace and defence sectors.

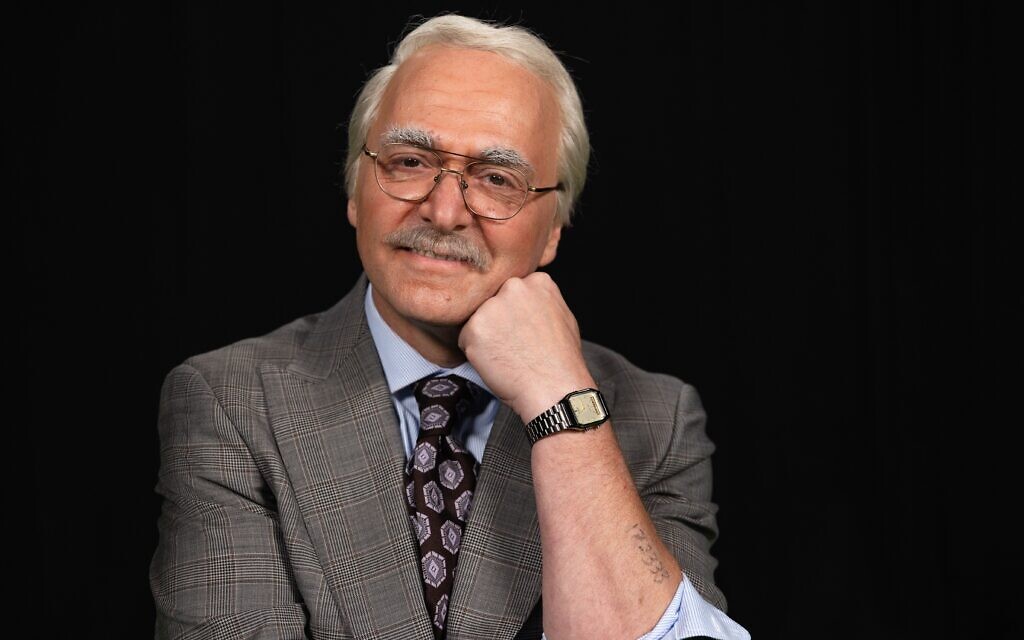

The Plato Global Alpha Fund Complex ETF (ASX: PGA1) also delivered solid results, returning 31% and ending the year at $36.74. PGA1 aims to outperform the MSCI World Net Returns Unhedged Index by 4% annually after fees. It holds over 250 shares, with significant contributions to its performance coming from tech giants such as Nvidia Corp (NASDAQ: NVDA), Microsoft Corp (NASDAQ: MSFT), and Broadcom Inc (NASDAQ: AVGO). This ETF began trading on the ASX in November 2024 and has drawn attention from investors like Andrew Wielandt from DP Wealth Advisory, who appreciates its focus on financials and defence sectors.

Investment Considerations and Future Outlook

As Australian investors assess their portfolios, the question remains whether to invest in these high-performing ETFs. While the returns have been remarkable, experts suggest considering other opportunities as well. For instance, Scott Phillips, an investing expert at Motley Fool, recently indicated that while the Global X Copper Miners ETF has performed well, there may be better investment options currently available.

The growing trend towards ETFs reflects a broader shift in investment strategies, with many investors seeking diversified, low-cost solutions. As the year progresses, the performance of these ETFs will continue to be closely monitored, particularly as global economic conditions evolve.

In conclusion, the strong returns from these ASX ETFs in 2025 highlight the potential benefits of diversifying portfolios through exchange-traded funds. Investors should remain informed and consider both current performance and future opportunities in the ever-changing market landscape.