Australia is poised to achieve record beef production in 2025, driven by higher cattle slaughter rates and increased carcass weights, according to a report released by the agribusiness banking specialist Rabobank. The report indicates that production is expected to reach approximately 2.9 million metric tonnes, marking an 11 per cent increase from 2024 levels. This surge in production aligns with rising export figures, which are projected to potentially reach new highs as well.

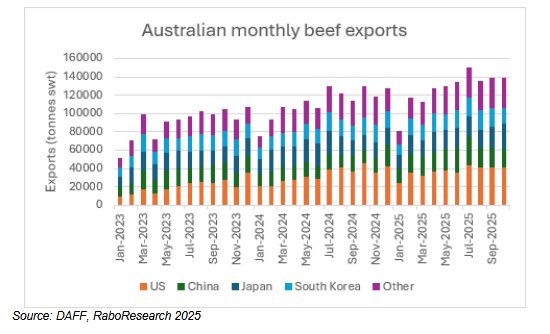

In the latest Q4 2025 Global Beef Quarterly, the RaboResearch division of Rabobank highlights that beef exports from Australia have risen by 15 per cent in the first ten months of 2025, amounting to 1.3 million metric tonnes shipped weight. The report’s lead author, Angus Gidley-Baird, senior animal proteins analyst at Rabobank, notes that the United States remains the largest market for Australian beef, accounting for 29 per cent of total exports.

Key Markets and Export Trends

While the majority of exports to the United States consist of grassfed beef, Gidley-Baird remarks that grainfed beef exports to the US have increased by 20 per cent in the first ten months of 2025, reaching 14,000 metric tonnes. Additionally, Australian beef exports to China have surged by 44 per cent during the same period, particularly in grainfed beef, which saw a substantial increase of 58 per cent. This growth is likely attributed to a decrease in US beef exports to China.

Seasonal conditions are currently the primary driver of the Australian cattle market, according to Gidley-Baird. He explains that with a relatively balanced cattle market, prices are heavily influenced by weather patterns and producer sentiment. Recent drier conditions impacted cattle-producing regions in September and October, leading to a temporary decline in prices. However, improved rainfall in late October contributed to a rebound in prices, a trend expected to persist through the end of 2025 and into 2026.

Global Beef Production Declines

On a global scale, beef production is projected to decline by 0.8 per cent in 2025 compared to 2024 levels. Gidley-Baird highlights that New Zealand is anticipated to experience the largest percentage drop in production, with a reduction of 4.7 per cent, equating to 34,000 metric tonnes. The United States, with its larger production base, is expected to see a decrease of nearly 500,000 metric tonnes, or four per cent, while Canada and the EU27+UK are also forecasted to experience contractions of 3.9 per cent and three per cent, respectively.

This overall contraction translates to an approximate reduction of 410,000 metric tonnes in global beef supplies when compared to 2024 totals. In contrast, Australia is on track for an 11 per cent increase in production volumes, bolstered by higher cattle inventory. Meanwhile, China is expected to witness a modest growth of one per cent, driven by elevated culling rates in the first half of the year.

Brazil is also projected to experience growth of 0.5 per cent in beef production in 2025, following unexpectedly high production levels in the first half of the year.

As the global beef market evolves, Rabobank’s report indicates that cattle prices in the northern hemisphere remain high compared to those in the southern hemisphere. While US and Canadian prices have seen slight contractions, Gidley-Baird attributes this trend more to seasonal conditions than to an increase in supply. In contrast, southern hemisphere cattle prices have generally increased, driven by demand from northern hemisphere markets.

Trade policies in the United States continue to impact beef trade dynamics. Gidley-Baird notes that Argentina’s increased quota into the US will facilitate greater volumes of beef at lower tariff rates, although it will take time for Argentina’s production levels to rise. The recent decision to remove reciprocal tariffs on beef trade is not expected to advantage any single supplier, while the elimination of a 40 per cent tariff on Brazilian beef is anticipated to boost Brazilian exports to the US, intensifying competitive pressures for Australian exporters. Despite these challenges, strong demand in the US is expected to sustain high levels of Australian exports.

The landscape of the global beef market is shifting, with Australia poised to capitalize on its record production levels while navigating the complexities of international trade and market demand.