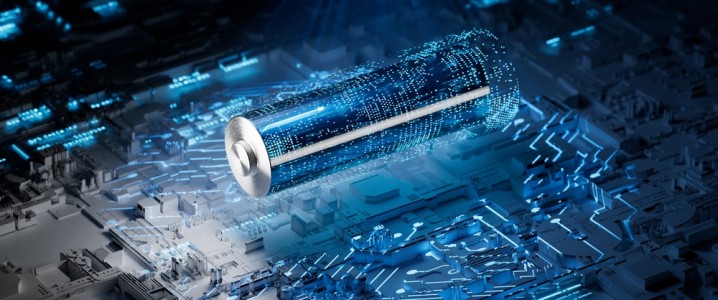

Demand for batteries used in electric vehicles (EVs) is expected to decline in 2026 due to changes in subsidy legislation in the United States, according to a recent financial report from LG Energy Solutions. The company cautioned that the combination of U.S. tariffs and the anticipated end of key EV subsidies would place significant pressure on automakers, potentially leading to increased vehicle prices and a slowdown in EV growth across North America.

In its latest quarterly financial statement, released this week, LG reported a rise in profits but expressed a cautious outlook for the industry. The company specifically noted that the recent passage of the One Big, Beautiful Bill by Congress is set to end the $7,500 EV subsidy that has incentivized many consumers to purchase electric vehicles. This change is scheduled for September 2024, and it is expected to dramatically affect EV sales in the United States. Additionally, the elimination of a $4,000 subsidy for second-hand EV purchases will also take effect in September.

Despite these challenges in the U.S. market, global EV sales have experienced growth throughout the year. In China, for instance, sales surged by 35% during the first four months, reaching approximately 3.3 million vehicles. This increase can be attributed to the government’s decision to extend its incentive program, which encourages consumers to trade in gasoline-powered vehicles for electric alternatives at a reduced cost.

While some regions are witnessing increased demand, other markets have not met manufacturers’ expectations for battery electric vehicle sales. This discrepancy has led some companies to pivot towards hybrid models instead. This trend poses challenges for battery manufacturers like LG, which have relied on the billions in pledged incentives under the Inflation Reduction Act to expand their battery production capacity.

To adapt to the shifting landscape, LG Energy Solutions has announced plans to redirect its EV battery manufacturing capacity towards producing energy storage batteries. This strategic move reflects the company’s efforts to align with changing market demands while continuing to innovate in the energy sector.

As the industry navigates these tumultuous changes, the future of battery demand and electric vehicle growth remains uncertain, particularly in light of evolving legislative and economic factors in the United States. The next few months will be crucial for both manufacturers and consumers as they respond to the impending subsidy reductions and tariff impacts.