Copper prices are experiencing a significant rebound following a sharp decline resulting from tariff concerns. The recent sell-off saw prices drop nearly 5% on October 12, 2025, but today’s market shows signs of recovery bolstered by strong demand from China and ongoing supply disruptions.

The price fluctuations have been influenced heavily by various factors, particularly supply constraints. Disruptions at the Grasberg mine in Indonesia, which is the world’s second-largest copper mine, have contributed to the tightening market. Operator Freeport-McMoRan declared force majeure weeks ago due to severe flooding that impacted production and resulted in tragic fatalities. In addition to this, other production issues have emerged in key copper-producing countries such as Chile and the Democratic Republic of Congo.

Market Dynamics and Demand Factors

The International Copper Study Group (ICSG) has projected a shift in the global refined copper market, anticipating a deficit of 150,000 metric tons by 2026, contradicting previous forecasts of a surplus. This change is attributed to a slowdown in production growth while demand for copper remains robust. Recent trade data from China indicates that total imports surged to a 17-month high, with copper imports rising by 24.4% year-on-year.

Market analysts note that despite the ongoing U.S.-China trade tensions, the demand for copper appears resilient. The data released showed a 7.4% year-on-year increase in imports, reflecting an unexpected strength in commodity demand, despite signs of softness in some domestic areas.

As the global shift towards electrification accelerates, the long-term outlook for copper is bullish. The metal is critical not just for electric vehicles but also for renewable energy infrastructure and various construction applications. Analysts predict that demand will continue to outstrip supply growth in the coming years, reinforcing a positive trend for copper prices.

Technical Analysis and Trading Strategies

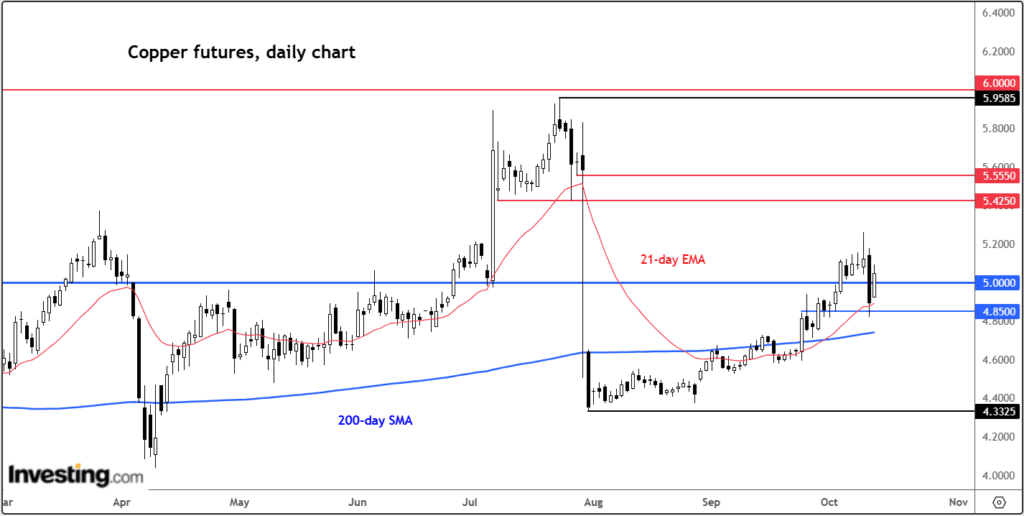

From a technical perspective, copper has shown encouraging signs of recovery after the recent volatility. Following the dip, prices have rebounded quickly, and a daily close above current levels could signal an acceleration in the bullish trend. The crossing of the 21-day exponential moving average above the 200-day simple average suggests a favorable trading environment for many investors.

Key support levels have emerged around the $5.000 mark, which is crucial for maintaining upward momentum. If prices hold above this level, analysts expect a potential rise toward resistance levels of $5.261 and possibly up to $5.425 and $5.555. A continued upward trend could lead to a target of $6.000 if the current momentum persists.

As market participants seek actionable strategies, the prevailing sentiment favors a dip-buying approach for copper. Investors are advised to keep a close watch on market developments, particularly as Federal Reserve Chair Jerome Powell is scheduled to speak at the International Monetary Fund’s autumn meetings, which could further influence market dynamics.

The copper market is poised for significant movements, driven by ongoing supply challenges and sustained demand, making it a focal point for traders and investors alike.