The recent decision by the Reserve Bank of Australia (RBA) to increase the official cash rate has left many families grappling with heightened mortgage pressures. On February 6, 2024, the RBA raised the cash rate by 25 basis points, bringing it from 3.6 percent to 3.85 percent. For homeowners like Mary Ters, this translates to significant financial strain, as her variable home loan interest rate is expected to rise to 5.61 percent on February 17, 2024, resulting in an additional monthly payment of $91.

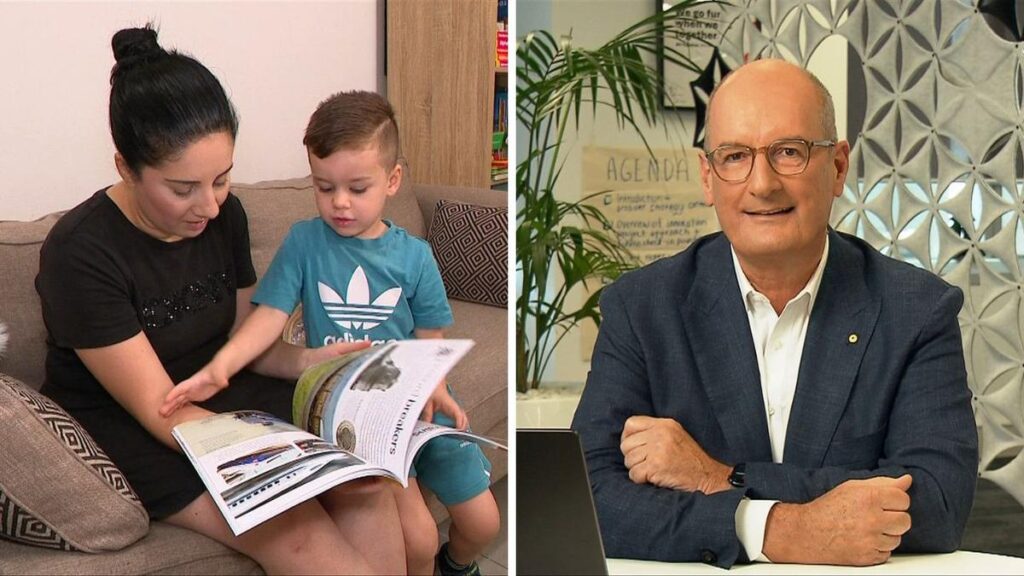

Mary, a mother from Australia, expressed her concerns following the announcement. “Like many Australians, obviously with any rate hike it just affects everything you do,” she stated. “It affects the amount of groceries you buy, it affects your bills. I just don’t understand how much more we can tighten our budgets.”

The financial landscape is challenging, but there are strategies that homeowners can implement to help alleviate the pressure on their mortgage repayments. Financial expert David ‘Kochie’ Koch provided valuable insights during a recent segment with Mary, outlining actionable steps for mortgage holders.

Evaluate Your Home Equity

One of the first recommendations Koch made was to assess the equity in the property. Over the past few years, many homeowners have seen their property values increase. Koch noted that understanding one’s equity can enhance negotiations with banks. “With the housing boom, a lot of people’s equity would have gone up,” he explained. “The bigger the equity, the more you can negotiate on the rate. It’s really important.”

Compare Rates and Negotiate

Another key strategy is to check what rates banks are currently offering new customers. For example, Westpac is providing a rate of 5.49 percent to new borrowers. Koch advised Mary to leverage her existing relationship with the bank and request a discount on her upcoming rate of 5.61 percent. “If they won’t negotiate, then look elsewhere to maybe refinance,” he suggested.

Koch also highlighted that mortgage holders should not hesitate to inquire about potential discounts. “Say to them, ‘I want a discount on the 5.61 percent that I’m going to be paying after the rate increase,’” he advised.

Consider Refinancing Options

Koch further discussed the possibility of refinancing as a viable option. He identified a comparable variable home loan rate at 5.44 percent, which could potentially save Mary approximately $62 per month, adding up to about $744 annually. Additionally, many lenders are offering cashback incentives ranging from $2,000 to $3,000 for customers who switch lenders.

When asked about fixing interest rates, Koch indicated that this would have been a prudent choice several weeks ago when fixed rates were around the 4 percent mark. “Now, because all the banks and finance lenders are preparing for not only this rate increase but potentially more, all those fixed rates have gone up, all over five percent,” he noted.

As families like Mary’s adjust their financial strategies in response to rising interest rates, it is crucial to stay informed and proactive. With practical tips from financial experts, homeowners can find ways to manage their mortgage repayments amidst an evolving economic landscape.

Throughout the week, 7NEWS will continue to provide insights on how to achieve real savings across various sectors, including energy bills and essential groceries. For further details, audiences can tune in to 7NEWS nightly at 18:00.