Flagship Minerals has made significant strides in uncovering the true potential of its Pantanillo gold-porphyry project located in Chile’s renowned Maricunga gold belt. The company has acquired an extensive dataset from Anglo American, revealing promising exploration opportunities and higher than anticipated gold mineralization levels.

The newly obtained Anglo American Norte dataset includes nearly 33,000 metres of drilling across 148 holes, along with over 2,100 samples of rock, soil, and stream sediment. This comprehensive data set has provided crucial insights into the Pantanillo deposit, highlighting multiple shallow, high-grade zones previously unidentified.

Recent analyses of soil data have uncovered an anomalous zone measuring approximately 5 km by 1.2 km, indicating substantial exploration potential surrounding the Pantanillo North gold deposit. The findings suggest that the extent of gold anomalism is significantly larger than what current drilling has indicated, with coinciding elevated copper and molybdenum levels reinforcing the presence of gold.

Managing Director Paul Lock expressed enthusiasm about the results, stating, “We are very pleased with the soil results. The large zone of anomalous gold essentially centred on the Pantanillo North deposit confirms our expectations that the Pantanillo Gold Project has the potential to yield handsomely around and along strike from the current 1.05Moz QFE pit shell.” He emphasized that the gold-in-soil anomaly is much larger than the existing drill coverage, measuring over six times in length and twice in width compared to the current pit shell.

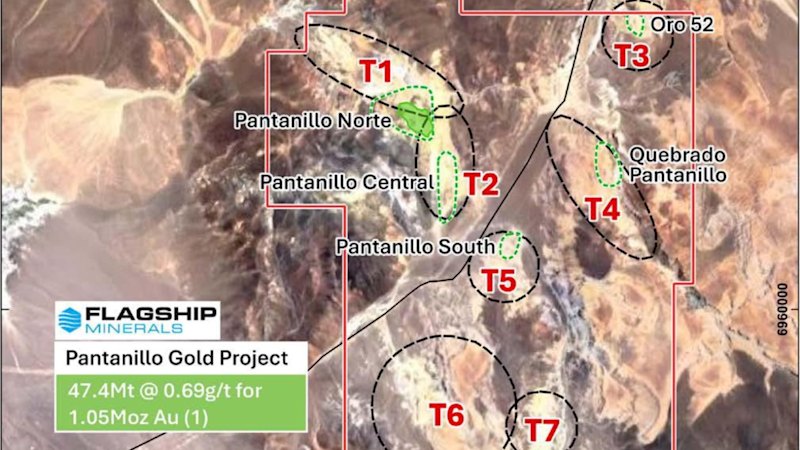

Pantanillo is situated in a region rich with large gold deposits, including the 27-million-ounce Norte Abierto mine and 10.7-million-ounce Maricunga project, both within proximity to Flagship’s site. The project area spans 110 square kilometers and contains numerous geophysical targets linked to magnetite and pyrite, which have been highlighted through magnetic surveying techniques.

Flagship initially focused on historical drill hole data to expedite the preparation of a JORC-compliant mineral resource estimate. Additionally, they are now evaluating other data, including over 1,500 samples from previous explorers such as Kinross Gold, which conducted sampling in 2006. This data is crucial for ongoing assessments and will inform future drilling strategies.

The soil sampling indicates a substantial gold anomaly that trends approximately northwest-southeast, aligning with the Pantanillo North deposit. Although current results reveal promising potential, further drilling is necessary to fully explore this anomaly.

Flagship’s overarching strategy for Pantanillo aims to define enough gold reserves to support a project development plan involving open-pit mining and heap leach processing. The company has set an ambitious target to produce 100,000 ounces of gold annually for at least a decade. Ongoing work focuses on converting existing Qualifying Foreign Estimates (QFE) into a Mineral Resource Estimate in accordance with the Australian JORC Code (2012), aiming to validate current drill data and enhance the existing resource without requiring additional drilling.

As work progresses, Flagship plans to leverage the new data to bolster the project’s metallurgical and feasibility aspects. The company is optimistic about the exploration potential for both oxide and higher-grade sulphide mineralization in the broader 110 km area surrounding the Pantanillo Gold Project. Should the incoming data meet expectations, Pantanillo could emerge as one of the fastest-growing gold resource stories in the industry this year.

With gold prices reaching new heights, trading above USD 40,000 for the first time, Flagship Minerals’ efforts to rework the Pantanillo data could prove highly advantageous for the company and its stakeholders.