Greater Western Water has reported a staggering operating cash loss of $191.7 million for the financial year 2024-25, primarily due to a disastrous upgrade of its IT billing system. The company, which serves approximately 600,000 households, is now facing escalating debts and may rely on public funds for operational stability in the upcoming years. State Treasurer Jaclyn Symes has committed to providing financial support to the utility until November 2026.

The financial turmoil was disclosed in the corporation’s annual report, released on December 24, 2023, revealing an alarming shift from a $50 million cash surplus the previous year to a significant deficit. This dramatic change highlights the severe impact of the IT upgrade problems, which resulted in delays in billing and collections. The report indicates that the corporation anticipates a credit loss allowance of $117.8 million, reflecting expected unpaid debts from customers.

The operational challenges stem from the rollout of a new customer billing system that has faced significant technical issues. According to the report, the delays in billing have resulted in lower cash receipts and an increase in interest expenses. “Management expects these delays to continue until the system issues are fully resolved,” the report stated. As a result, Greater Western Water may require additional financial assistance to sustain its operations into the next fiscal year.

While Jaclyn Symes has assured ongoing financial support, concerns over the corporation’s financial viability persist. A government spokesperson noted that four out of five residential accounts are now functioning properly, acknowledging that the billing issues have adversely affected customers. “Their service fell well short of customer and our expectations,” the spokesperson added.

The situation has drawn criticism from political opponents, with Opposition Leader Jess Wilson labeling Symes’ support as a “de facto bailout.” Wilson expressed her discontent over the timing of the report’s release, suggesting it was an attempt to evade accountability. She remarked, “Under Labor, Greater Western Water does not have enough cash to pay the interest bill on their debt and would likely be insolvent without emergency financial support.”

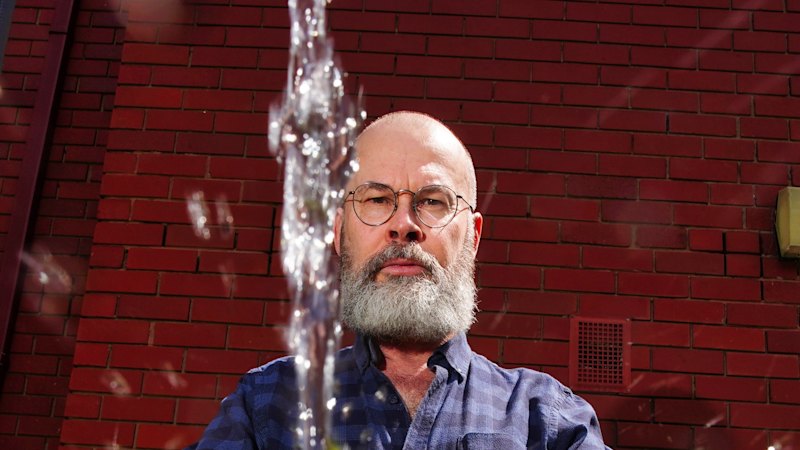

The financial metrics reveal a troubling trend for Greater Western Water. Over the past five years, its debt levels have surged, with the gearing ratio rising from 59.2 percent in 2021 to 69 percent in 2025, surpassing the Essential Services Commission’s benchmark of 60 percent. RMIT University emeritus professor in public policy David Hayward commented on the implications of the rising debt, stating, “If there is a cash operating deficit, that’s trouble. It means they are not getting enough cash their way.”

Despite these challenges, Craig Dixon, the acting managing director of Greater Western Water, expressed confidence in the corporation’s stability. He noted, “We remain a financially secure organisation delivering essential services to more than 600,000 customers, with strong government support.” Dixon acknowledged that the corporation had escalated borrowings to fund essential infrastructure projects.

The billing system upgrade, which cost over $100 million, was launched in May 2024 but quickly became problematic. The new system failed to generate bills automatically, forcing staff to manually check each bill, leading to delays and inaccuracies. Complaints regarding payment issues surged by more than 200 percent, with customers expressing frustration over the disruption.

In response to the ongoing crisis, the Essential Services Commission has implemented a $130 million redress scheme. This scheme includes writing off unbilled charges from 2024 and providing credits ranging from $80 to $240 to affected customers. Approximately 70,000 customers who experienced payment suspensions will also receive an $80 credit.

Former water minister Lisa Neville, who took over as chair of Greater Western Water in April, has publicly apologized for the distress caused by the IT failures. “Our customers deserve better, and we take full responsibility for what’s happened,” she stated, promising decisive measures to rectify the situation, including waiving approximately $75 million in unbilled charges.

As Greater Western Water navigates through this financial crisis, the reliance on government support raises questions about the future sustainability of the utility. If the current trend of increasing debt and operational deficits continues, the state government may be forced to allocate additional resources to ensure the corporation’s viability, potentially impacting other areas of the budget. The forthcoming months will be crucial as the utility seeks to regain customer trust and stabilize its financial position.