Nvidia’s stock is under pressure as the company grapples with increasing competition and concerns regarding the sustainability of artificial intelligence spending. Shares of the chipmaker have fallen approximately 8 per cent since reaching a record high on October 29, 2026, significantly lagging behind the performance of the S&P 500 Index. Following an impressive surge of over 1,300 per cent since the end of 2022, Nvidia’s market capitalization has now dropped to about $4.6 trillion, a loss of $460 billion within just a few months.

The recent downturn is particularly striking considering that Nvidia’s market value was over $5 trillion on the day it last hit an all-time high. The company has seen its stock value plummet, although it still boasts an impressive three-year gain of nearly 1,200 per cent. On Tuesday, shares rose slightly by 0.7 per cent, reflecting ongoing interest despite the broader concerns.

Competition intensifies as rivals, such as Advanced Micro Devices, ramp up their efforts in the AI chip market. Major clients like Alphabet and Amazon are also developing in-house chips to reduce reliance on Nvidia, which could threaten its market dominance. Analysts are expressing increasing apprehension about Nvidia’s investments in customer companies, suggesting these could artificially inflate demand for its products. “The risks have clearly risen,” stated JoAnne Feeney, partner and portfolio manager at Advisors Capital Management, which manages $13 billion in assets.

Market Dynamics and Demand for Nvidia Products

The impact of a downturn in Nvidia’s stock would reverberate through equity markets. Since the bull market began in October 2022, Nvidia accounts for approximately 16 per cent of the S&P 500’s overall gains, according to data from Bloomberg. In contrast, Apple, the next largest contributor, is responsible for about 7 per cent. Despite these challenges, demand for Nvidia shares remains robust. The company is currently trading at a lower valuation compared to many of its peers in the technology sector, even as it anticipates a 57 per cent profit growth on a 53 per cent increase in sales for its next fiscal year, which concludes on January 31, 2027.

Wall Street appears to maintain confidence in Nvidia, with 76 out of 82 analysts covering the company holding buy ratings. The average price target suggests a potential gain of 37 per cent in the next year, which would elevate its market value beyond $6 trillion. “Nvidia is still likely to be one of the fastest growing companies in public markets,” Feeney added, affirming the company’s continued attractiveness to investors.

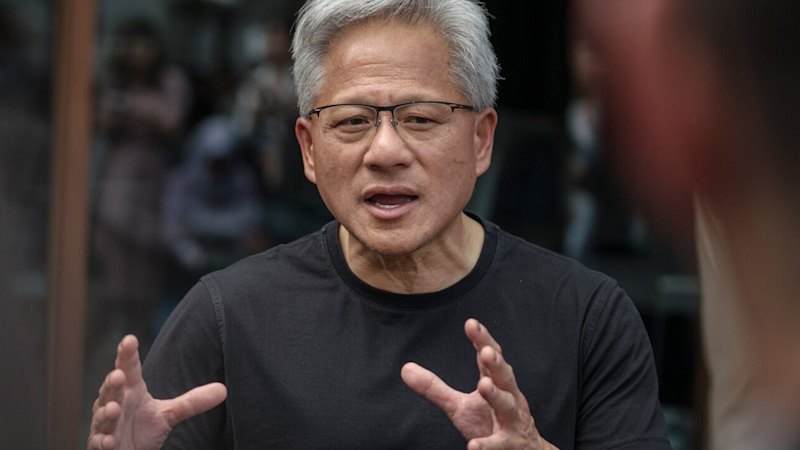

Chief Executive Officer Jensen Huang recently announced at the CES trade show in Las Vegas that Nvidia’s next-generation chips, known as Rubin, are set to be released this year. “Demand for Nvidia GPUs is skyrocketing,” Huang asserted, highlighting the rapid advancements in AI model capabilities that are expected to drive further demand.

Challenges from Competitors and Market Trends

Despite its current market strength, Nvidia faces significant challenges from emerging competitors. Advanced Micro Devices has secured substantial data center contracts with firms like OpenAI and Oracle, with projections indicating a 60 per cent increase in its data center revenue, reaching nearly $26 billion by 2026. Additionally, major clients such as Alphabet and Amazon have begun developing their own chip technologies to mitigate costs associated with purchasing Nvidia’s products, which can exceed $30,000 each.

As Michael O’Rourke, chief market strategist at Jonestrading, noted, “People will use less costly chips if they can.” This sentiment reflects a growing trend that could pose a threat to Nvidia’s grip on the market. Alphabet’s Google has been creating its own tensor processing units for over a decade, further demonstrating the competitive landscape. Recent reports suggest that Meta Platforms is negotiating with Google Cloud for chip rentals, further indicating the shift in strategy among tech giants.

Despite these developments, demand for Nvidia’s chips remains high. Analysts from Bloomberg Intelligence, including Kunjan Sobhani and Oscar Hernandez Tejada, predict that Nvidia’s market share will remain stable in the foreseeable future. “The market is underestimating Nvidia’s position,” wrote analysts from Morgan Stanley, maintaining a buy rating on the stock.

Investment from major tech players is projected to exceed $400 billion in 2026 for capital expenditures, with a significant portion allocated for data center infrastructure. OpenAI has committed to spending $1.4 trillion in the coming years, despite uncertainties regarding its financial sustainability.

As investors evaluate Nvidia’s profit margins, they remain vigilant regarding the potential impact of lower-priced competitors. The company’s gross margin, a crucial profitability metric, was in the mid-70s percentage range for fiscal years 2024 and 2025 but is expected to dip to 71.2 per cent for fiscal 2026 due to costs related to the rollout of its Blackwell series chips. Nvidia anticipates a rebound to around 75 per cent in fiscal 2027, making margin performance a focal point for investors.

Nvidia’s current valuation, trading at 25 times anticipated profits over the next year, positions it favorably compared to most of its peers in the tech sector. Analysts from Bank of America view this as an investment opportunity, suggesting that Nvidia is currently undervalued given its potential for growth amid ongoing advancements in AI technology. As the market evolves, Nvidia will need to navigate these challenges while leveraging its technological leadership to maintain its competitive edge.