Recent data indicates that house prices in Australia have surged by approximately 38% over the past five years. This increase is not merely a housing market issue but is intertwined with the broader cost of living crisis affecting households across the country. Alongside rising energy costs, the financial pressures stemming from escalating housing prices are influencing various aspects of family dynamics, including marriage and divorce.

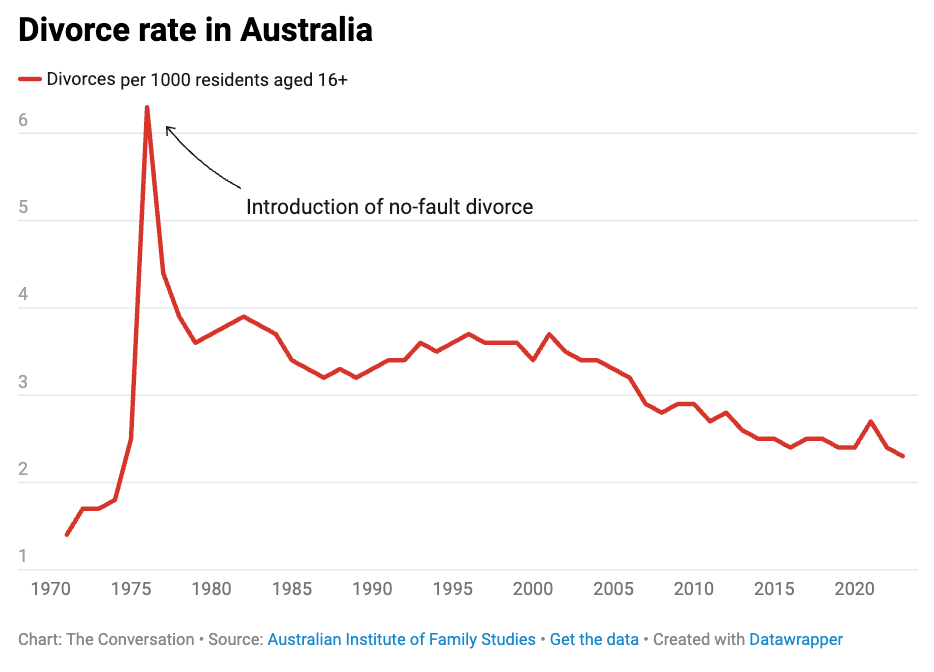

As divorce rates in Australia reach their lowest levels since the introduction of no-fault divorce in 1976, the question arises: why aren’t more couples separating? Historical trends indicate that financial hardships, such as those experienced during the 1990s recession, typically correlate with higher divorce rates. Yet, current circumstances suggest that many couples may feel financially trapped, preventing them from pursuing divorce even if they desire to do so.

The financial implications of divorce can be substantial. Couples often weigh the costs of separation against the benefits of remaining married. Economic theories suggest that individuals are more likely to marry when the anticipated benefits of marriage outweigh the advantages of being single. As circumstances shift, individuals may reassess these benefits, leading to decisions about separation based on financial realities.

Research shows a strong connection between housing prices and household behaviors. Higher housing costs can deter couples from separating, as maintaining a single household is generally more economical than managing two. This reality creates a dilemma for couples contemplating divorce, as the costs associated with higher housing prices can influence their decisions to remain together.

Interestingly, higher housing prices can also provide some advantages to couples considering separation. For homeowners, rising property values mean that the assets they would divide upon divorce are more valuable. This potential financial security might encourage some couples to consider separation, particularly if they believe the benefits of divorce would outweigh the costs.

A recent study presented by Stephen Whelan and Luke Hartigan from the University of Sydney at the Australian Conference of Economists examined the relationship between housing price fluctuations and divorce rates. Their analysis utilized data from the Household, Income and Labour Dynamics in Australia (HILDA) survey, revealing that unexpected changes in housing prices significantly impact divorce likelihood.

Notably, the researchers found that positive shocks in housing prices could keep couples in marriages they might otherwise leave. This effect is particularly pronounced among women with lower education levels, low-income households, and older couples. Conversely, homeowners experiencing lower-than-expected price growth are more likely to consider separation, as the financial burden of maintaining two households becomes less daunting.

The findings underscore the importance of understanding the economic factors at play in marital decisions. High housing costs may force individuals to remain in relationships that are not fulfilling, leading to negative consequences for their overall well-being. Such dynamics emphasize the need for policy interventions that can mitigate these financial barriers.

Support programs like the Leaving Violence Program aim to alleviate the financial strains associated with separation, providing vital assistance to those in potentially dangerous situations. By addressing the financial challenges that accompany divorce, these initiatives can help individuals reclaim their independence and well-being.

In conclusion, the interplay between soaring housing prices and marital stability is a complex issue that warrants further attention. As families navigate the financial landscape shaped by rising costs, understanding the implications for marriage and divorce remains crucial for policymakers and social scientists alike.