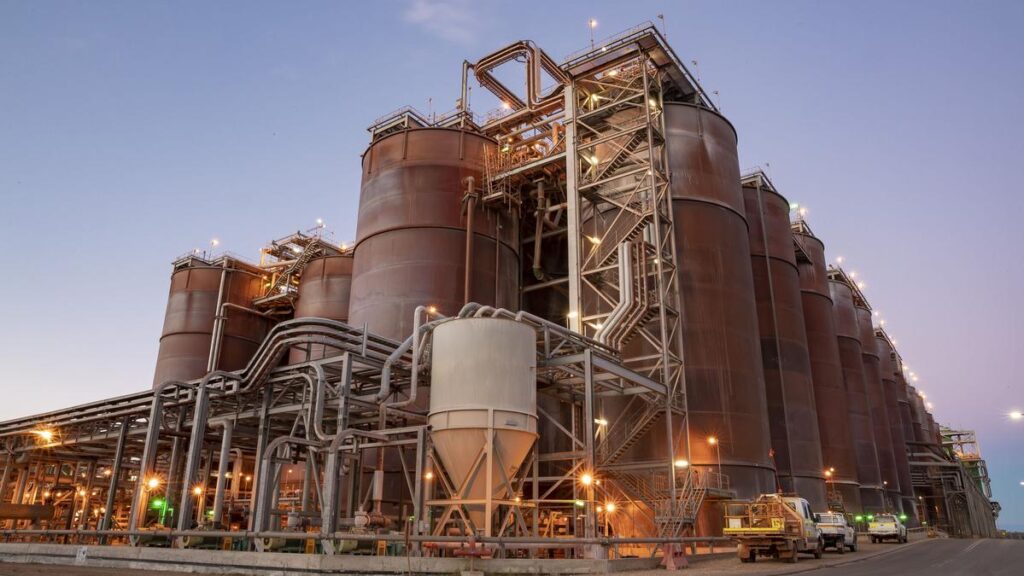

The Worsley Alumina operation.

South32 has reported stable quarterly performance, resulting in a significant rise in its share price, which reached its highest point since April 2023. The mixed metal miner’s stock increased by 5.3 percent to close at $4.40. This uptick comes after the company maintained its production and cost guidance for the financial year ending in June 2026, following a consistent December quarter as described by outgoing chief executive Graham Kerr.

Production Highlights and Strategic Investments

Alumina production was a standout aspect of South32’s quarterly results, showing a 3 percent increase in the second half of 2025. This boost was attributed to record output in Brazil and steady performance from the Worsley operation in Western Australia, which achieved planned volumes while undergoing necessary maintenance. Analyst Kaan Peker from RBC Capital Markets noted that the strong volume and cost performance is particularly encouraging given concerns over seasonal fires and wet weather.

South32 continues to invest heavily in its projects, pouring $338 million into the Hermosa project in Arizona during the half-year period. This investment is aimed at advancing construction on the shafts and surface infrastructure necessary for the Taylor zinc-lead-silver deposit, as well as completing the decline for the Clark battery-grade manganese deposit. Peker remarked on the strong momentum in development projects at Hermosa, indicating a positive outlook for the company’s future.

Leadership Transition and Future Plans

In addition to positive quarterly results, South32 is preparing for a leadership transition. Matthew Daley, currently the technical and operational director at Anglo American, will join South32 on February 2, 2026, as the new deputy chief executive. Daley is set to take over as chief executive when Kerr steps down later in 2026. His compensation package includes a base salary of $2 million per year, along with short-term incentives targeting 120 percent of his base salary and long-term incentives valued at 200 percent of his salary.

Kerr has led South32 since its inception following a demerger from BHP in October 2014, with the company officially beginning trading on the Australian Securities Exchange in May 2015. Daley’s move comes as Anglo American has successfully navigated multiple takeover attempts from BHP in 2024, highlighting his leadership experience in the mining sector.

As South32 continues to execute its strategy and manage its portfolio, the market response reflects investor confidence in the company’s direction under new leadership and ongoing project development.