WASHINGTON (AP) — Federal Reserve Chair Jerome Powell reiterated his cautious stance on interest rates during a conference in Sintra, Portugal, stating that the central bank will maintain its current rate while assessing the economic impact of President Donald Trump’s tariffs. Despite persistent criticism from the White House, which advocates for lower borrowing costs, Powell emphasized a “wait and see” approach.

Powell, addressing an audience at a European Central Bank event, noted that U.S. inflation might rise later this summer. However, he acknowledged the uncertainty surrounding the timing and extent of any price increases due to the tariffs. “As long as the economy is in solid shape, we think the prudent thing to do is to wait and see what those effects might be,” Powell remarked, referencing the tariffs imposed by Trump this year.

The Ongoing Tension Between the Fed and the White House

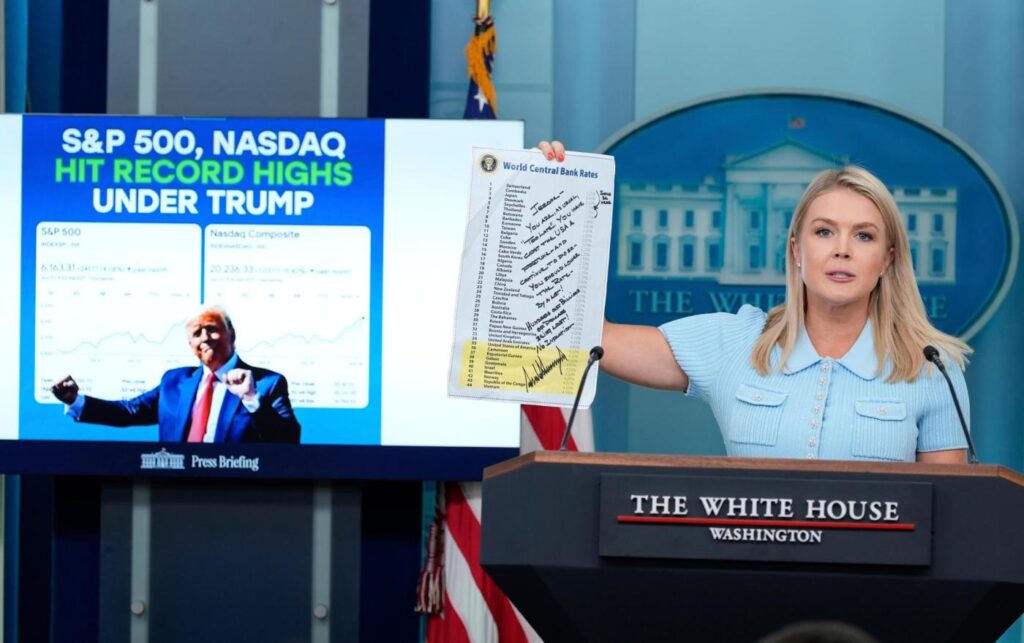

The comments from Powell highlight the ongoing tension between the Federal Reserve and the Trump administration. President Trump has consistently urged the Fed to lower its key rate, arguing that it would reduce interest costs on the federal government’s substantial debt and stimulate economic growth. This conflict has raised concerns about the Fed’s independence from political influence, although financial markets have largely dismissed Trump’s criticisms since the Supreme Court indicated that the president cannot dismiss the Fed chair.

Powell also mentioned that, absent the tariffs, the Fed might have already reduced its key rate. The central bank decided to pause after evaluating the potential inflationary impact of Trump’s proposed tariffs. Despite this, Powell did not entirely rule out a rate cut at the upcoming Fed policy meeting scheduled for July 29-30. “I wouldn’t take any meeting off the table or put it directly on the table,” he stated, although most economists anticipate that any rate reduction would not occur before September.

Trump’s Escalating Criticism

On Monday, President Trump extended his criticisms beyond Powell to the entire Federal Reserve Board, which plays a role in interest-rate decisions. “The board just sits there and watches, so they are equally to blame,” Trump declared. This intensifies pressure on individual Fed officials, such as Governor Chris Waller, who are considered potential successors to Powell when his term concludes in May 2026.

The Fed has maintained its key short-term interest rate at approximately 4.3% throughout the year, following three rate cuts in 2024. During a June news conference, Powell suggested that the central bank would gain more insight over the summer regarding the inflationary effects of Trump’s tariffs, hinting that a rate cut might not be considered until September.

Expert Opinions and Future Implications

Despite Powell’s cautious approach, some Fed governors, including Trump appointees Waller and Michelle Bowman, have expressed skepticism about the tariffs’ potential to cause long-term inflation. Both have indicated a likelihood of supporting a rate cut at the July meeting.

“The board just sits there and watches, so they are equally to blame,” Trump said, increasing pressure on the Fed.

As the Fed navigates these political and economic challenges, the implications for the U.S. economy remain uncertain. The central bank’s decisions in the coming months will be closely watched, particularly as it balances the need to support economic growth with the potential risks of inflation.

This development follows a series of economic and political maneuvers that have tested the Fed’s autonomy and its ability to respond effectively to external pressures. The outcome of these dynamics will likely influence not only the U.S. economy but also global financial markets.

Looking ahead, the Fed’s policy decisions will be crucial in determining the trajectory of the U.S. economy, especially as it contends with the broader implications of trade policies and geopolitical tensions.