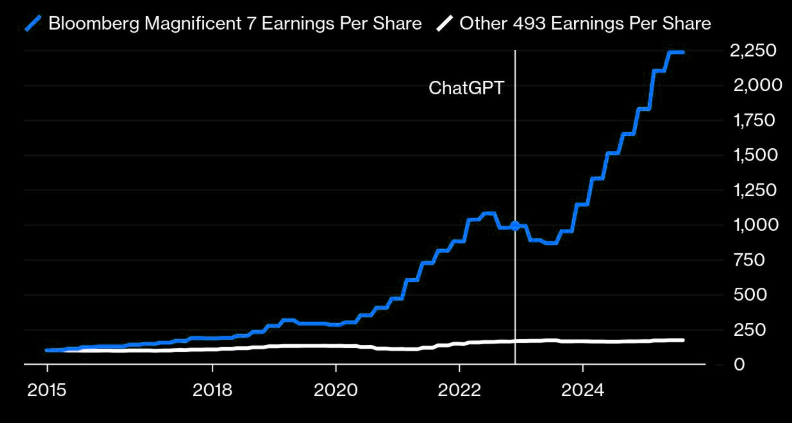

Wall Street analysts project robust earnings growth for the S&P 500 in 2026, forecasting a significant increase of approximately 15 percent. This prediction, according to FactSet, marks a continuation of a trend where earnings per share (EPS) have seen double-digit growth for three consecutive years. The optimism is largely attributed to the sustained performance of major technology and communications companies, collectively referred to as the “Magnificent Seven.”

While the top seven firms are expected to drive earnings growth, the remaining 493 companies within the S&P 500 have shown little change in earnings estimates since April. This disparity highlights the concentrated nature of projected growth, raising concerns about the sustainability of overall market performance. Analysts suggest that the anticipated earnings growth is essential for justifying potential price increases of between 8 percent and 17 percent for the index in 2026.

Economic Factors Influencing Earnings Growth

The projected earnings growth for 2026 is influenced by broader economic conditions. Analysts expect U.S. GDP growth to remain stable, with forecasts suggesting an annual increase of around 2 percent. This economic backdrop is crucial as it supports corporate profitability, particularly in sectors experiencing fiscal stimulus from recent policies, such as the OBBB, which aims to reduce taxes and deregulate certain industries.

Nevertheless, the optimistic earnings forecasts are not guaranteed. Analysts emphasize that these projections are based on current estimates and may be revised downward as actual economic conditions unfold. For instance, sustained earnings growth is intricately linked to various factors, including economic expansion, input costs, and labor market dynamics. If the economy grows at a moderate rate, corporate revenues are likely to expand correspondingly. However, if inflation persists or employment trends decline, profit margins—currently at their highest since 2008—could face significant pressure.

Risks of Over-Optimism and Valuation Concerns

Despite the upbeat sentiment, analysts caution about the risks inherent in high valuations. The current price-to-earnings ratio for the S&P 500 stands at approximately 22 times forward earnings, which is above historical averages. This situation suggests that the market is banking on continued earnings momentum. Should growth slow or profit margins compress, even minor disappointments in earnings could lead to stock price declines.

Historically, earnings estimates have shown a tendency to drift lower throughout the year as actual results become clearer. This pattern is often driven by structural vulnerabilities within the economy. As noted, profit margins are elevated, making them difficult to sustain in a challenging economic environment. The reliance on a small group of high-performing technology companies further exacerbates the risk; if these firms encounter setbacks, the overall earnings landscape could suffer disproportionately.

Investors are advised to monitor several key indicators as 2026 approaches. Analysts typically revise forecasts downward early in the year, and tracking these revisions can provide valuable insights into market trends. Additionally, maintaining a focus on high-quality companies with strong fundamentals can be beneficial, particularly during periods of earnings disappointment.

In conclusion, while Wall Street’s forecast for 2026 is optimistic, it is essential for investors to remain vigilant. The interplay between economic growth, corporate profitability, and market valuations will be critical in shaping the earnings landscape. As such, prudent investment strategies should consider the potential for volatility and the risks associated with over-reliance on a narrow set of growth contributors.