It remains one of the most memorable images of this century, albeit for all the wrong reasons: President George Bush, standing on the deck of the USS Abraham Lincoln in May 2003, delivering a speech on the war in Iraq with a massive banner behind him declaring “mission accomplished.” The war, however, continued well into the next decade, amplifying terrorism and destabilizing the Middle East. This image serves as a stark reminder of premature declarations of victory.

In contrast, the Reserve Bank of Australia (RBA) is unlikely to produce a “mission accomplished” banner for Governor Michele Bullock when she addresses the nation next week. Bullock is expected to confirm that inflation in Australia continues to fall, the job market remains resilient, and the economy is expanding. Most economists and financial markets anticipate that Bullock will announce a further quarter percentage point cut in official interest rates after the bank’s monetary policy committee meeting. This would reduce the cash rate to 3.6 percent, marking the third rate cut this year and the first time the bank has delivered back-to-back rate cuts since March 2020.

Australia’s Economic Path

Even if the RBA decides to hold rates steady at their July meeting, markets and economists are aligned in predicting a rate cut in August, with another likely towards November. Such a move would be unprecedented in the RBA’s history, as it manages to ease interest rates without the economy experiencing a downturn or soaring unemployment.

The RBA’s cautious approach contrasts sharply with its past actions. In the late 1980s, the fight against inflation led to Australia’s deepest postwar recession. Unemployment had fallen to 5.8 percent in late 1989, just as the bank increased the cash rate to 18 percent. It took until 2003 for unemployment to return to 5.8 percent.

The RBA has two primary objectives: keep inflation between 2 and 3 percent, and maximize employment.

Despite criticism over the past 14 months, the RBA has managed to maintain steady unemployment rates, adding more than 1.1 million jobs since it began lifting rates. This achievement comes amid global challenges such as the COVID-19 pandemic, the invasion of Ukraine, and the ongoing Middle East conflict.

Contrasting the US Economic Landscape

Meanwhile, the situation in the United States presents a stark contrast. President Donald Trump is openly at odds with the head of the Federal Reserve, Jerome Powell. Trump has criticized the Fed for maintaining interest rates at 4.25-4.5 percent, largely due to concerns that his tariff policies could drive up inflation. This week, Trump took his grievances to a new level, publishing a list of 44 nations and their official interest rates, with the US ranked 35th highest.

“Jerome – you are, as usual, ‘Too Late’. You have cost the USA a fortune and continue to do so. You should lower the rate – by a lot!” Trump declared.

The list, however, was unusual, comparing US interest rates with those in countries like Cuba and Libya, while omitting nations such as Iceland or Indonesia. The omission of key economic players underscores the complexity of Trump’s economic policies.

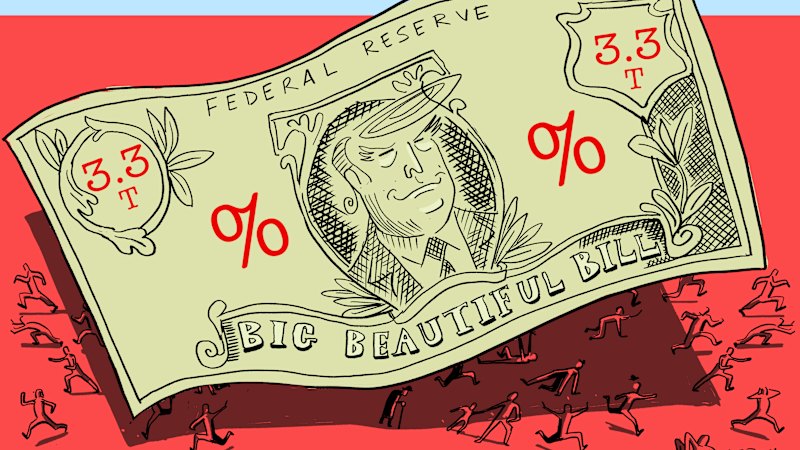

Trump’s fiscal policies have also drawn scrutiny. The US ran a $316 billion budget deficit in May alone, contributing to a cumulative deficit of $1.4 trillion for the 2024-25 financial year. The US Senate and House recently passed versions of Trump’s Big Beautiful Bill, which is expected to add $3.3 trillion to federal deficits over the next decade.

Global Implications and Future Outlook

While Trump pressures Powell to lower interest rates, Powell remains focused on his responsibilities. Speaking at a central banking meeting in Portugal, Powell emphasized the need for the US to address its unsustainable fiscal path sooner rather than later.

“The US fiscal path is not a sustainable one. The level of debt is sustainable, but the path is not, and we need to address that sooner or later. Sooner is better than later,” Powell stated.

This economic tension in the US contrasts with the more stable situation in Australia. Governor Michele Bullock can point to falling inflation, steady employment, and economic growth as indicators of the RBA’s successful policy settings. A potential rate cut on Tuesday could further bolster the economy, offering relief to households and providing insurance against future global uncertainties.

As the world watches, Australia’s economic resilience serves as a testament to the RBA’s strategic approach, providing a beacon of stability amid global financial turmoil.