It remains one of the most memorable images of this century for all the wrong reasons: President George Bush, on the deck of the USS Abraham Lincoln in May 2003, delivering a speech on the war in Iraq with a huge banner behind him declaring “mission accomplished.” The war continued well into the next decade, amplifying terrorism and destabilizing the Middle East. Fast forward to today, and a different kind of economic mission is being quietly achieved in Australia, without the fanfare of a banner.

Next week, Reserve Bank of Australia (RBA) Governor Michele Bullock is expected to confirm that inflation in Australia is continuing to fall, the jobs market remains resilient, and the economy is expanding. Most economists and financial markets anticipate a further quarter percentage point cut in official interest rates after the bank’s monetary policy committee meeting on Tuesday. This would lower the cash rate to 3.6 percent, marking the third rate cut this year and the first instance of back-to-back cuts since March 2020.

Australia’s Economic Strategy

Even if the RBA decides to hold rates steady at their July meeting, market consensus suggests a rate cut in August and another towards November. Such an easing of official interest rates without the economy tanking or unemployment soaring would be a significant departure from the RBA’s historical approach. In the late 1980s, the fight against inflation led to Australia’s deepest postwar recession, with unemployment peaking after the cash rate was raised to 18 percent.

Despite facing criticism from both hawks and doves over the past 14 months, the RBA has managed to maintain steady unemployment and add over 1.1 million jobs since it began lifting rates. This achievement is notable given the global economic uncertainties, including the COVID-19 pandemic, the invasion of Ukraine, and ongoing tensions in the Middle East.

Comparisons with the United States

Meanwhile, across the Pacific, President Donald Trump is embroiled in a public dispute with Federal Reserve Chair Jerome Powell. Trump has criticized Powell for keeping interest rates steady at 4.25-4.5 percent, arguing that his tariff policies are not inflationary. In a dramatic move, Trump published a list comparing US interest rates with those of 44 other nations, including some with vastly different economic contexts.

“Jerome – you are, as usual, ‘Too Late’. You have cost the USA a fortune and continue to do so. You should lower the rate – by a lot!” Trump declared.

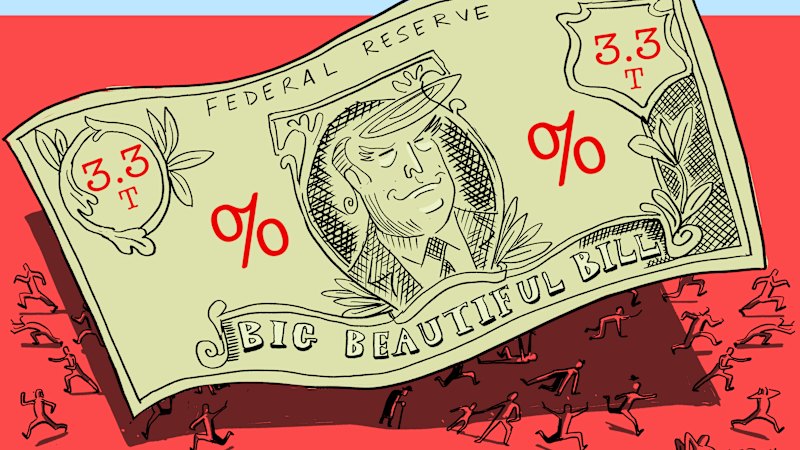

This unusual comparison highlights the tension between the White House and the Federal Reserve. Trump’s administration is currently grappling with a $US316 billion budget deficit as of May, with a cumulative deficit of $US1.4 trillion for the 2024-25 financial year. The US Senate and House have passed versions of Trump’s Big Beautiful Bill, which the Congressional Budget Office estimates will add $US3.3 trillion to federal deficits over the next decade.

Global Economic Implications

The financial ramifications of Trump’s policies have strained his relationship with former allies like Elon Musk and increased pressure on Powell to lower interest rates. While Trump compares American rates with those in countries like Libya, Powell remains focused on maintaining economic stability, as evidenced by his recent comments at a central banking conference in Portugal.

“The US fiscal path is not a sustainable one. The level of debt is sustainable, but the path is not, and we need to address that sooner or later. Sooner is better than later,” Powell stated.

In contrast, the situation in Australia appears more stable. The RBA’s policy settings have delivered an economic soft landing, with inflation falling, employment steady, and the economy growing. Another rate cut would provide further relief to households and offer some insurance against global economic uncertainties.

As Australia navigates its economic challenges, the country remains a world away from the political and financial turmoil in the United States. While tensions between governments and reserve banks are not unheard of, Australia has yet to experience the level of discord seen between Trump and Powell. Governor Bullock can point to a scoreboard showing positive economic indicators, a testament to the RBA’s cautious and measured approach.