The Minister for Home Affairs, Tony Burke, has proposed new powers to enable the CEO of the Australian Transaction Reports and Analysis Centre (AUSTRAC) to restrict or prohibit certain high-risk products, services, or delivery channels. This amendment aims to provide additional tools to mitigate money laundering risks associated with these high-risk offerings.

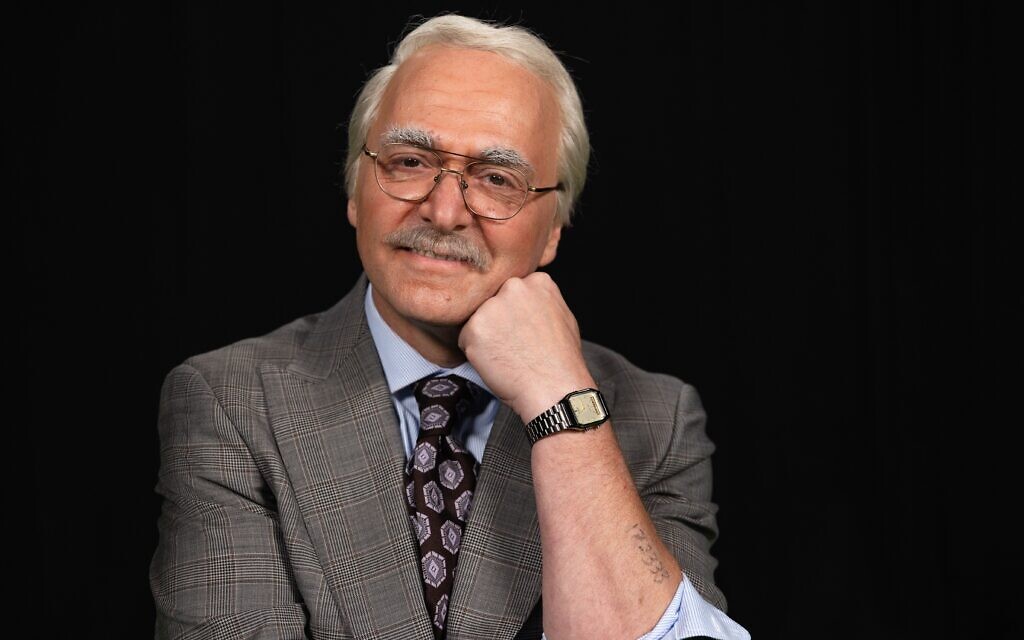

Brendan Thomas, the AUSTRAC CEO, expressed his support for the proposed changes, stating that if the Parliament approves the law, AUSTRAC will be prepared to implement these measures. “We’re still seeing an unacceptable risk of money laundering across some channels,” Mr. Thomas noted. He emphasized that the new authority would allow the CEO to respond more effectively to the evolving risk environment.

One significant concern highlighted by Mr. Thomas is the growing integration of cryptocurrency transactions into money laundering methodologies. He mentioned that crypto ATMs present heightened risks due to their ability to convert cash into digital currency, which can then be sent instantly and virtually anonymously around the world.

In the past six years, the number of operational crypto ATMs in Australia has surged from just 23 to approximately 2,000. The AUSTRAC Crypto Taskforce estimates that nearly 150,000 transactions occur annually through these machines, facilitating the movement of around $275 million each year.

The majority of high-value transactions conducted via crypto ATMs are linked to scams and the activities of money mules. In a recent analysis of a sample of 90 prominent crypto ATM users, AUSTRAC and its law enforcement partners found that 85 percent were either scam victims or money mules coerced into transferring funds. Notably, individuals aged 50-70 are the primary users of these ATMs, accounting for almost 72 percent of the transaction value, indicating their vulnerability to scams.

The current Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regime mandates that businesses implement effective transaction monitoring and customer due diligence, as well as submit transaction threshold and suspicious matter reports. However, organized crime continues to devise innovative methods for laundering money, complicating the enforcement of these controls.

Mr. Thomas welcomed Minister Burke’s announcement, emphasizing the importance of equipping AUSTRAC with enhanced powers to better safeguard the community. Further details regarding the proposed amendments are expected to be made available in due course.