Noronex Limited, an Australian Securities Exchange-listed company, has intensified its exploration efforts in Namibia, focusing on uranium targets identified through a recent ground spectrometry survey at its Etango North project. The survey, which covered 244 line-kilometres, has pinpointed several promising areas that complement Noronex’s artificial intelligence modelling conducted earlier this year.

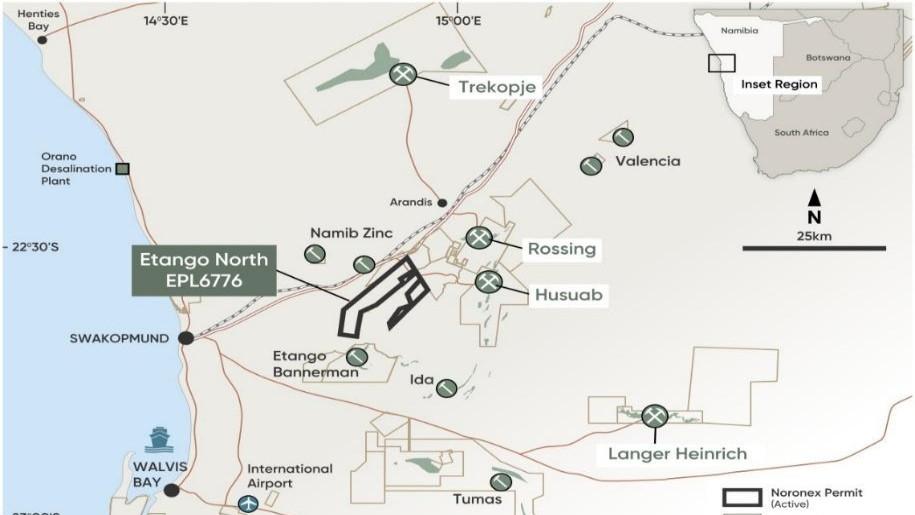

Located in the heart of Namibia’s uranium corridor, this region is renowned for hosting significant uranium deposits, including the 207-million-pound Etango deposit owned by Bannerman Energy, as well as the operational Rossing and Husab mines. The ground survey, conducted by Terratec Geophysical Services, measured levels of uranium, thorium, and potassium. Notably, the analysis revealed multiple high uranium-thorium ratios, indicating potential uranium-bearing alaskite formations.

Several of these high readings align with uranium discoveries reported in historical drilling by Bannerman. Noronex’s Etango North project operates as a joint venture with a local Namibian partner, allowing the company to earn up to 80 percent of the project for a payment of N$8 million (approximately A$650,000) over four years.

Exploration Plans Underway

Eager to validate the anomalies identified in the survey, Noronex has commenced field inspections. Upcoming activities include soil sampling and portable X-ray fluorescence profiling, with a shallow drilling campaign scheduled for later this year. The geological setting of the Etango North project is particularly encouraging, characterized by volcanic alaskite rocks similar to those at the well-established Rossing and Husab mines.

The geological features of the area include dome-shaped folds and trap-like bends, which are conducive to the accumulation of uranium-rich deposits. Despite the promising indications, little prior exploration has been conducted in the area; historical efforts by Bannerman primarily focused on a thorium anomaly, with only 12 shallow holes drilled, mainly targeting rare earth elements rather than uranium.

Recent spectrometry results suggest that past exploration efforts may have overlooked significant uranium potential in untouched areas highlighted by the new findings. Noronex speculates that surficial cover might obscure broader target zones, indicating the presence of larger anomalies beneath the surface.

Strategic Position in the Market

With these new insights, Noronex is well-positioned to deploy drilling rigs and explore the depth potential of the uranium system. As global demand for uranium rises due to a shift towards cleaner energy solutions, the company’s activities in Namibia could see it emerge as a key player in one of the world’s leading uranium corridors.

In addition to its uranium pursuits, Noronex is also exploring copper opportunities within the country. The company holds a Joint Ore Reserves Committee (JORC) resource of 10 million tonnes at 1.3 percent copper in its Witvlei project. Furthermore, it has established a strategic exploration alliance with mining giant South32 in Botswana’s Kalahari Copper Belt, further expanding its resource prospects.

As Noronex advances its exploration efforts at Etango North and prepares for future drilling, the company’s timing aligns well with the increasing appetite for uranium in the global energy market. The developments in Namibia position Noronex as a noteworthy contender in the uranium sector, with the potential to unlock significant value in the coming years.