Sony Group has officially ceded control of its global television business, transferring majority ownership to China’s TCL Electronics. This significant move highlights the challenges faced by Japanese electronics giants in the competitive display market. On January 20, 2026, Sony announced the formation of a new joint venture, with TCL acquiring a controlling 51% stake while Sony retains 49%.

Under this arrangement, TCL will manage all aspects of television operations, including product development, industrial design, and global distribution. This shift transforms what was previously a supplier relationship into a substantial takeover, indicating a dramatic change in Sony’s strategy.

Strategic Dynamics in the Television Market

The joint venture is set to commence operations in April 2027, coinciding with the beginning of Japan’s financial year. As part of this agreement, Sony will contribute its brand value, image-processing technology, and audio expertise, while TCL will handle manufacturing and logistics. Analysts point out that this partnership allows Sony to maintain a premium retail presence without bearing the significant capital costs associated with modern panel fabrication.

Sony’s retreat comes in the context of a fierce global competition over next-generation television technology. Just weeks before this announcement, Sony had registered the trademark “True RGB,” signaling its intent to re-enter the premium television segment with an innovative display architecture. Yet, the absence of a major television launch at CES 2026 raised questions about Sony’s ongoing strategy in a market dominated by aggressive competitors.

True RGB Technology and Market Implications

The partnership’s most anticipated outcome is the development of the True RGB LED backlighting system, which is expected to feature in Sony’s upcoming flagship models. This technology represents a significant advancement over traditional Mini LED systems by utilizing direct RGB emission, eliminating color filters, and achieving extreme performance metrics. Reports indicate that these new models could deliver brightness levels exceeding 4,000 nits and improved energy efficiency, positioning them as formidable challengers in the high-end market.

TCL’s expertise in QD-Mini LED technology and its ownership of CSOT, one of the largest display panel manufacturers, provides the operational strength needed for this endeavor. Meanwhile, Sony’s advanced XR Processor and dimming algorithms will enhance picture quality, setting a new standard for consumer television.

The shift in control to TCL reflects broader trends in the electronics industry, where Japanese brands have struggled to maintain their market share against rising Chinese competitors. Iconic companies such as Sharp, Toshiba, and Panasonic have exited the television market, highlighting a significant decline in Japan’s dominance in this sector.

As Sony transitions from hardware manufacturing to focusing on intellectual property and entertainment, the company aims to redefine its role in the industry. Revenue from Sony’s display segment dropped by 10% to 597 billion yen (approximately $3.8 billion) in the fiscal year ending March 2025, prompting a reevaluation of its business strategy.

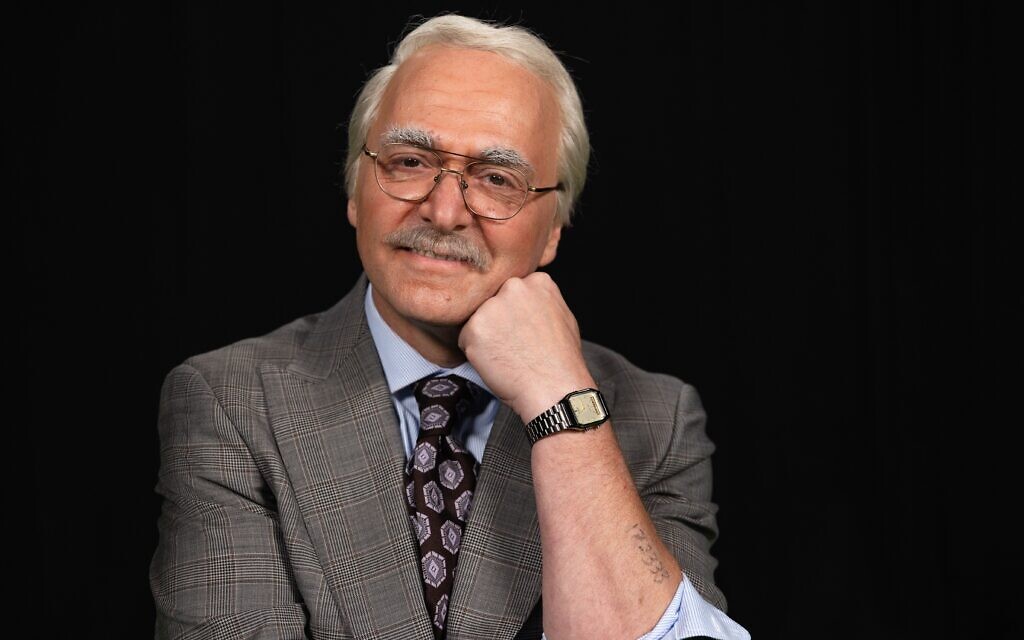

While CEO Kimio Maki framed the partnership as a leap forward in technology, the reality remains that control of one of Japan’s most iconic consumer electronics brands has shifted decisively to a Chinese company. As the race for dominance in RGB television technology heats up, Sony will continue to be part of the conversation, albeit from a different vantage point.