UPDATE: Anteris Technologies, a leading heart medtech company, has successfully secured $39 million through an urgent capital raising effort, driven by overwhelming demand. The placement, launched on Friday, originally aimed to raise $30 million to bolster the execution of Anteris’ clinical strategy but was quickly upsized due to investor interest.

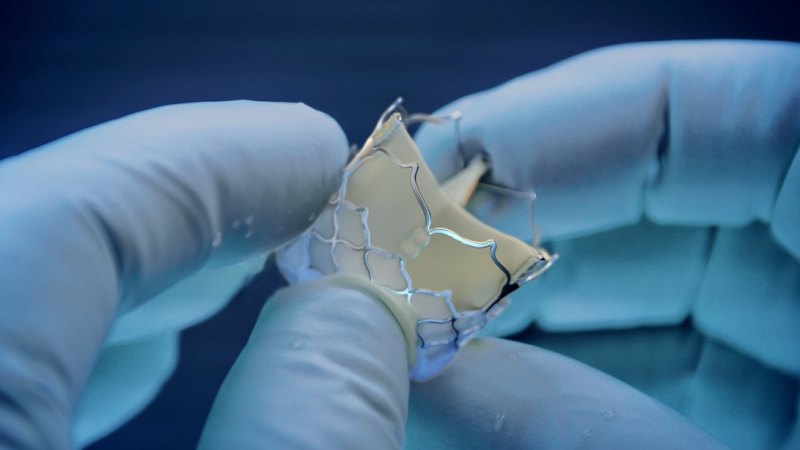

The company, backed by L1 Capital and Sio Partners, offered new ASX-listed chess depositary interests at $7.50 per share, reflecting a 14.8 percent discount to the previous close. This strategic move comes as Anteris ramps up trials for its flagship heart valve technology, DurAVR, designed to address aortic stenosis—a condition that narrows the aortic valve and restricts blood flow.

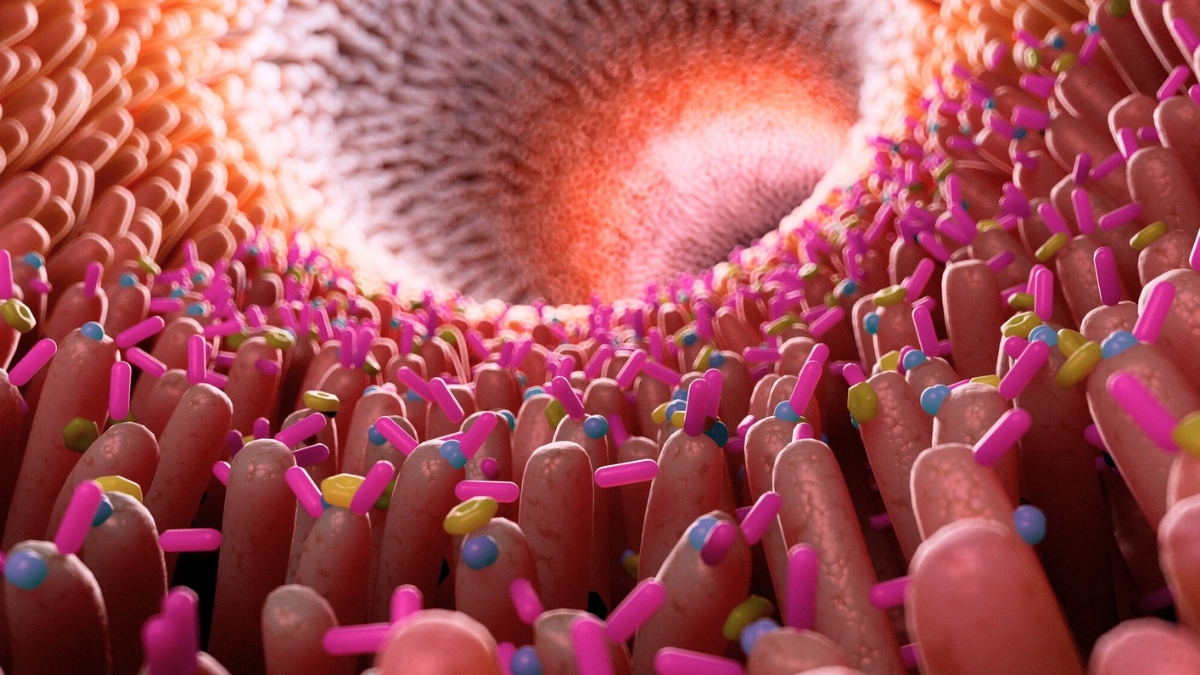

Since 2021, Anteris has been trialing its DurAVR prosthetic aortic valve on human subjects, successfully treating 130 patients to date. This significant milestone underscores the immediate impact of their technology on patients’ lives, providing hope for those suffering from severe heart conditions.

Despite facing challenges, including being removed from the All Ordinaries index in September 2023 and a 22 percent decline in share prices over the past year, Anteris has seen a resurgence in recent months. The company recently announced a testing and manufacturing agreement with Switchback Medical, along with positive quarterly results and updates on its pivotal Paradigm trial, set to commence this month.

The urgency of this funding round highlights the critical need for innovative solutions in heart health, and Anteris is positioned to make a significant impact in the medical field. Investors are keenly watching how this capital will be utilized to advance their clinical strategies and bring their groundbreaking technology to more patients in need.

As developments unfold, stakeholders and healthcare professionals alike are eager to see how Anteris Technologies will leverage this new funding to enhance patient care and drive forward its ambitious clinical goals. Stay tuned for more updates on this evolving story.