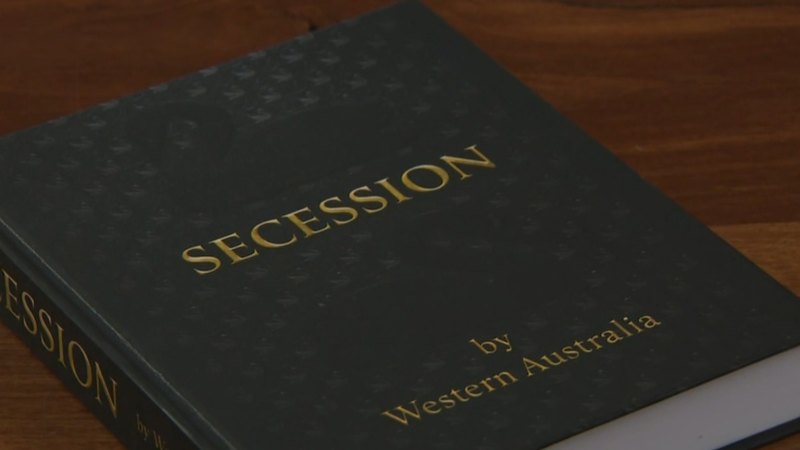

UPDATE: Australia is on the verge of introducing new regulations to ensure continued access to cash amid reports that the nation’s physical currency is under significant pressure. The Council of Financial Regulators has just announced plans for fresh powers that would enable the federal government to oversee cash distribution services, emphasizing the importance of maintaining physical currency in a predominantly cashless society.

The urgent call for these regulations follows a troubling trend where the use of cash for payments is rapidly declining. According to the Reserve Bank of Australia, approximately 1.5 million Australians still rely on cash for four out of five in-person transactions. This demographic includes vulnerable groups, such as the elderly and those in regional and rural communities, highlighting the critical need for accessible physical currency.

In a report released earlier today, the Council highlights the urgency of the situation, stating, “The decline in the use of cash for payments in Australia has challenged the economics of the cash distribution sector.” The report proposes that a minimum reporting standard be established for businesses providing cash, enabling better oversight and accountability.

The government could intervene to set prices in situations where cash distribution services and service providers fail to reach agreements. This recommendation comes in the wake of a substantial $50 million bailout for cash transporter Armaguard in 2024, funded by major retailers and banks, aimed at stabilizing the cash distribution sector.

Treasurer Jim Chalmers stressed the importance of maintaining cash access, stating, “We recognize that the availability of cash is important, and that’s what this is all about.” He confirmed that the Council is actively consulting on options to improve the cash distribution system in Australia.

The report also notes that cash serves as a vital fallback for communities during natural disasters and outages, making its circulation essential during times of uncertainty. As cash transactions dwindle, the task of keeping paper currency flowing from cash register to cash register has become increasingly challenging.

Authorities are set to gather public submissions as they prepare to finalize their recommendations by 2025. With the potential for significant changes to the cash distribution landscape, Australians are urged to stay informed and engaged with these developments as they unfold.

The implications of these proposed regulations could reshape how Australians interact with their money and ensure that those who depend on cash continue to have access to this essential resource. As the consultation process progresses, the nation watches closely, recognizing that the future of cash is at stake.

Stay updated with the latest developments by downloading the 7NEWS app today.