UPDATE: Australia’s unemployment rate skyrocketed to 4.5% in September 2023, marking the highest level since November 2021. This unexpected rise from 4.3% has significant implications for the economy and the Reserve Bank of Australia’s monetary policy.

Officials confirmed the alarming news earlier today, revealing that the unemployment rate has now remained above 4% for the past ten months. This trend raises urgent questions about the state of the labor market and could lead to a critical reassessment of interest rates during the Reserve Bank’s upcoming meeting in November.

The Reserve Bank has previously maintained a favorable outlook on employment conditions, stating in its September decision that labor market conditions were “broadly steady.” However, today’s startling figures challenge this perspective, as the pathway to achieving full employment becomes increasingly unclear.

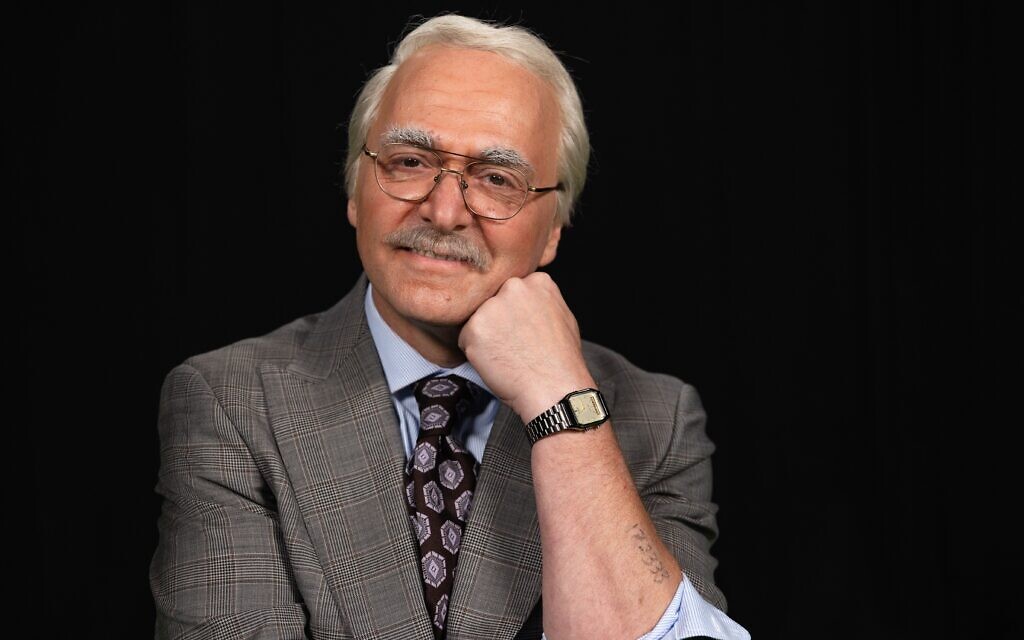

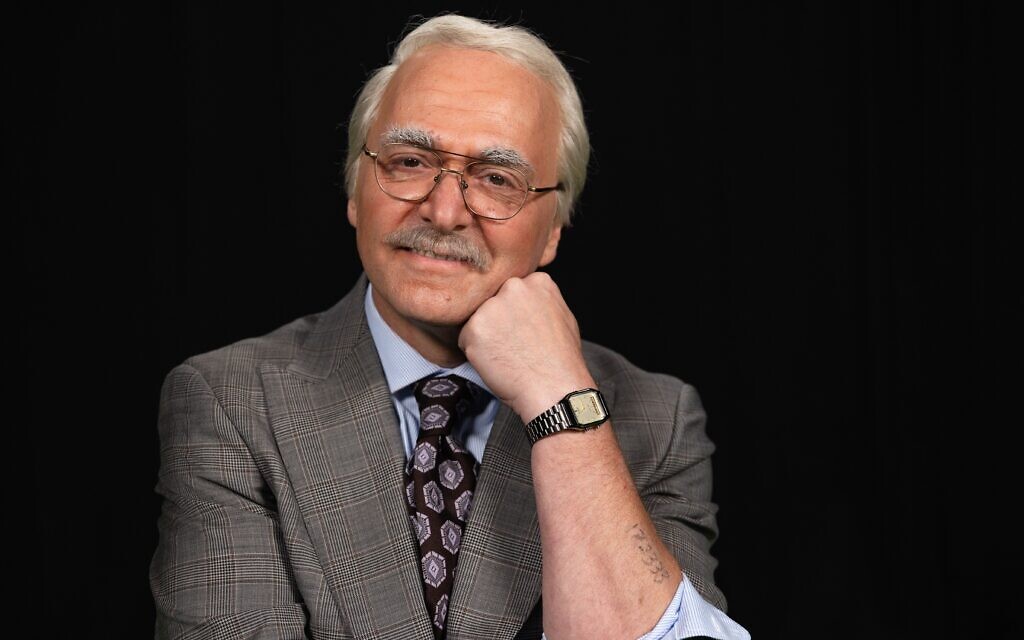

Jeff Borland, a professor of economics at The University of Melbourne, highlights the gravity of the situation. “The latest data shows a weakening labor market, with employment growth decelerating significantly,” he stated. With an average of only 12,900 new jobs created each month in 2025, the pace is a stark decline compared to 32,600 in 2024.

The rising unemployment rate is attributed to a growing number of job seekers, with an average increase of 22,100 people looking for work each month this year. The disparity between job seekers and job creation has led to this concerning upward trend in unemployment.

Moreover, the total hours worked have declined sharply. In 2024, monthly hours grew by 0.27%, while in 2025, this figure plummeted to just 0.04%. The total stock of jobs increased by 351,600 last year but has slowed to only 44,100 in the first half of 2025.

As private employers respond to perceived economic weakness, the overall labor market is showing clear signs of strain. The once-stable growth in non-market employment is no longer sufficient to offset declines in market sector jobs, further emphasizing the urgent need for economic intervention.

This latest spike in unemployment is not only a statistic; it represents real lives affected by economic fluctuations. The implications for families and communities across Australia cannot be underestimated as the country navigates these challenging times.

As we look ahead, the Reserve Bank will need to confront these developments head-on. What actions will they take to address the rising unemployment, and how will this impact interest rates moving forward? Stay tuned as we cover this evolving story.