URGENT UPDATE: Global stocks are holding steady as traders eagerly anticipate a critical speech from Federal Reserve Chair Jerome Powell at the annual Jackson Hole symposium. This address, scheduled for this weekend, could significantly impact the future of U.S. monetary policy and has investors on high alert.

Market sentiment is tense as Powell faces sharp criticism from U.S. President Donald Trump, raising concerns over the potential implications for the Fed’s independence. The latest data shows a troubling surge in U.S. producer prices for July, leading many investors to reassess their positions on expected rate cuts. Futures markets now indicate only a 66% chance of a 25 basis point cut at the Federal Reserve’s next meeting in September, down from 85% just one week ago.

Analysts are closely watching Powell’s tone regarding a September rate cut, particularly in light of recent labor market weakness. Nabil Milali, a portfolio manager at Edmond de Rothschild Asset Management, stated, “A cautious tone from Powell could shift market expectations to a 50-50 call on rate cuts.” He also noted that Powell might take this opportunity to defend the Fed’s independence, highlighting the unofficial theme of the meeting.

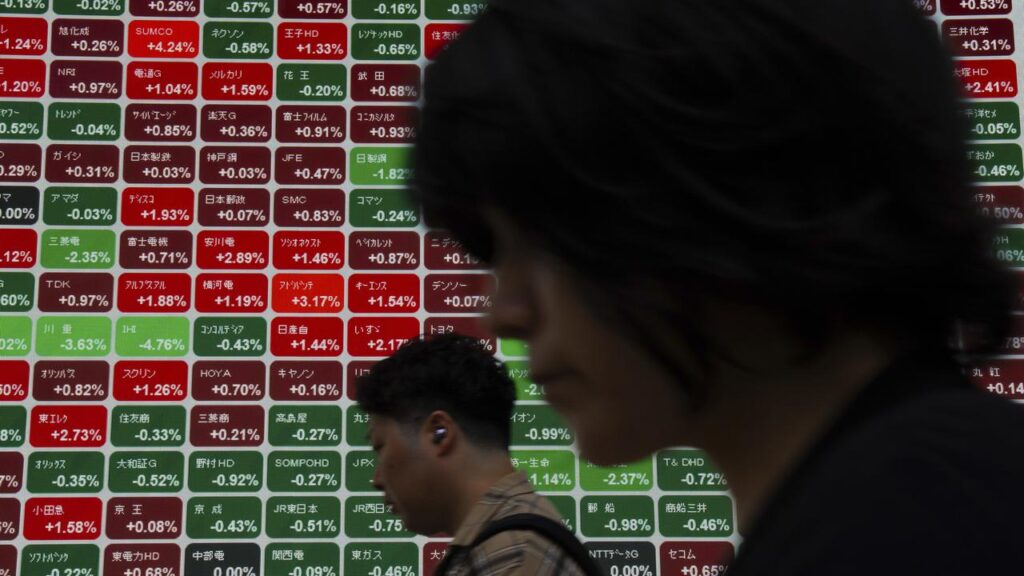

Currently, MSCI’s broadest index of global stocks is flat, with European markets showing slight gains in early trading. Meanwhile, Wall Street futures are up by 0.1% to 0.2%. In Asia, China’s CSI 300 Index surged by 2.1% after a significant upgrade to DeepSeek’s V3 AI model and reports that Nvidia requested Foxconn to halt work on its H20 AI chip, boosting Chinese competitors.

The dollar index rose by 0.1%, while the euro slipped to $1.15985 after revisions indicated a 0.3% contraction in Germany’s economy for the second quarter. In Japan, core consumer prices decelerated for the second consecutive month in July, yet remained above the central bank’s target of 2%, keeping rate hike expectations alive. Despite this, the yen is poised for a 1% decline this week.

Adding to the developments, Bank of Japan (BOJ) Governor Kazuo Ueda is also slated to speak at Jackson Hole, further heightening the event’s significance for global markets.

Oil prices dipped slightly, with Brent crude trading down by 0.2% to $67.5 per barrel, following a volatile week amid escalating tensions between Russia and Ukraine. Gold prices have also edged lower, with spot bullion down 0.2% at $3,330.9 per ounce.

As the Jackson Hole symposium approaches, all eyes are on Powell’s speech, which could either reinforce or challenge market expectations for U.S. monetary policy. The implications of his remarks could resonate across global markets, making this a pivotal moment for investors everywhere. Stay tuned for updates as this story develops.