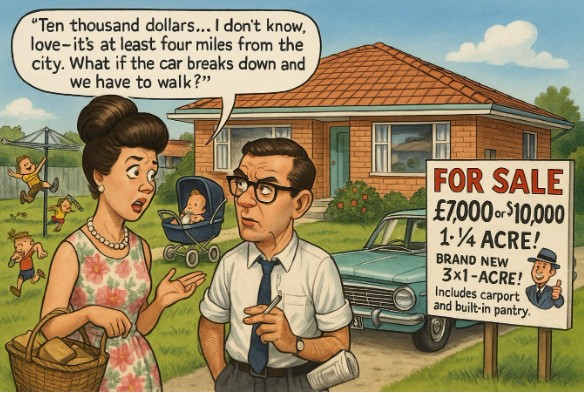

UPDATE: The housing crisis in Perth has reached a breaking point as home prices soar to an alarming $900,000, leaving many young families facing the harsh reality of permanent exclusion from home ownership. With wages barely doubling from $50,000 to $100,000 over the past 25 years, the dream of owning a home is slipping away for Australia’s next generation.

New reports confirm that unless young Australians marry into wealth or receive parental assistance, the prospect of home ownership is increasingly bleak. Rising costs are forcing them into suburbs far from job opportunities, where risks and aspirations are stifled. Instead of pursuing entrepreneurial endeavors or exploring career options abroad, many are settling for stable, low-risk jobs, trapped by the staggering cost of living.

Economic analyst Michael Green has shed light on this urgent issue in his recent essays. He highlights a critical misalignment between government poverty measurements and the real cost of modern living. Using outdated formulas, governments have failed to address the realities of today’s economy, leaving families struggling under the weight of housing, childcare, and healthcare costs.

Green’s analysis reveals that the true threshold for a middle-class life in the U.S. has shifted dramatically. The updated poverty line for a family of four is now around $200,000 AUD, not the outdated figures currently being used. In Australia, the OECD’s “relative poverty line” of $63,800 fails to reflect the reality faced by families living in cities like Perth, where average rent consumes $36,000 annually.

The implications are dire: young adults are forced to navigate a housing market that now requires a mortgage of at least $700,000, with repayments that can reach $50,000 a year. This financial burden prevents them from taking risks or making long-term plans, effectively stunting their aspirations.

Housing affordability is not merely a buzzword; it’s an urgent crisis demanding immediate attention. The current model is unsustainable, as families are left with little to no disposable income after covering essential expenses. The stark reality is further exacerbated by rising prices for childcare, transportation, and healthcare—each essential expense has surged beyond the reach of the typical household budget.

The narrative that rising house prices equate to increased wealth is misleading. Homeowners may see their property values climb, but the reality is that selling a $1 million home only leads to purchasing another similarly priced property. This cycle traps young Australians in a system designed to benefit those already on the property ladder.

With Perth’s housing market spiraling out of control, the need for a fundamental shift in policy is urgent. Green suggests that instead of continuing to inflate the market with subsidies, governments should focus on creating affordable housing options. This means rethinking zoning laws and allowing for the development of spacious, affordable land outside urban centers.

The economic landscape is changing, and without intervention, Perth could mirror the trends seen in countries like Japan and Italy, where populations are declining and housing markets are stagnating. The growing divide between generations poses a significant threat to the Australian dream of home ownership.

As the situation develops, the political class must confront the reality of the housing crisis. The future of countless young Australians hangs in the balance, with the dream of home ownership slipping away. The time for action is NOW—before the next generation is left with no options but to watch their dreams fade.

The urgency of this crisis cannot be overstated. Young families across Australia are asking: will they ever be able to own a home? The answer depends on the decisions made today.