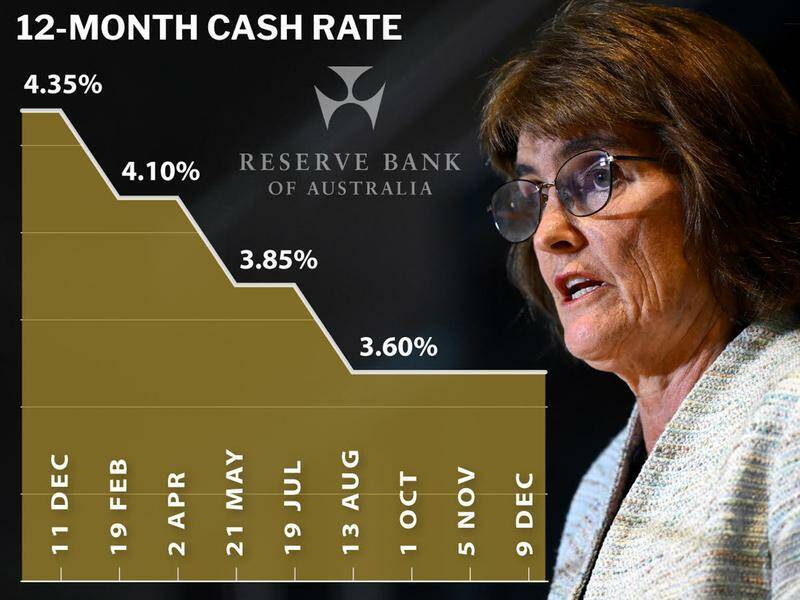

URGENT UPDATE: The Reserve Bank of Australia (RBA) has just revealed critical conditions that could lead to interest rate hikes in 2026. As inflation data is set to be released on January 28, 2026, this information is essential for all Australians concerned about their financial futures.

New reports indicate that the RBA’s recent board meeting minutes, disclosed on Tuesday, highlight a growing concern among officials about persistent inflationary pressures. NAB chief economist Sally Auld commented that the central bank is increasingly anxious that these pressures are shifting from temporary factors to more entrenched economic realities.

During the December meeting, RBA Governor Michele Bullock noted that while a rate hike was not explicitly on the agenda, discussions revolved around the scenarios that would necessitate such a move in 2026. Two critical factors must align to avoid rate increases:

1. Inflation data must indicate that the recent rise in prices is attributable to short-term volatility rather than more stable components like market services and new housing, both of which have seen unexpected growth.

2. The RBA needs assurance that financial conditions remain restrictive enough to exert downward pressure on inflation.

Debate among board members is ongoing. Some argue that rising home prices and competitive banking conditions suggest that financial environments are no longer restrictive. Others contend that the anticipated gradual rise in unemployment in 2025 points to continued restrictions.

Market analysts are already pricing in a 25% to 33% chance of a rate hike at the upcoming February meeting, underscoring the urgency of the situation. Despite the RBA’s hawkish comments in December, market reactions have been surprisingly subdued.

Analysts predict that NAB’s estimate of a 0.9% increase in underlying inflation for the December quarter could complicate the RBA’s ability to maintain its current stance. Meanwhile, JP Morgan analyst Tom Kennedy estimates a 0.8% rise in underlying inflation, suggesting it may not significantly disrupt RBA forecasts.

As Australians await clarity on these developments, the implications for the economy and individual finances are profound. The upcoming inflation figures will be pivotal, shaping monetary policy and potentially impacting mortgage rates and consumer spending.

Stay tuned for further updates as the situation evolves. The next RBA meeting is just around the corner, and the stakes have never been higher.