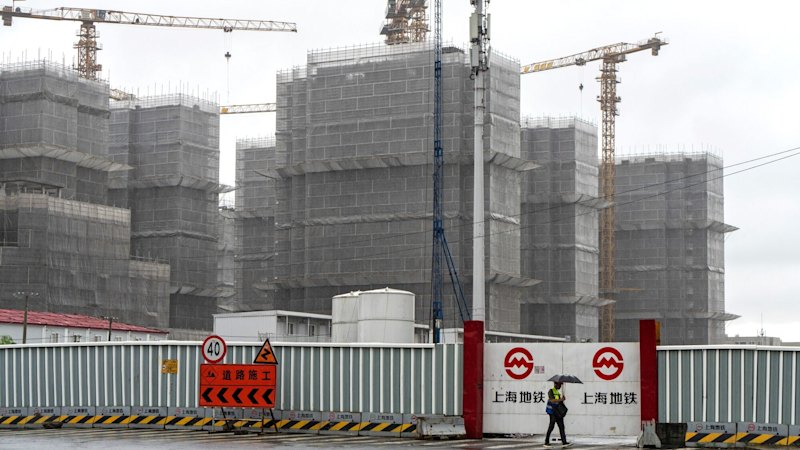

China’s fixed asset investment experienced a significant decline for the third consecutive month in November 2023, according to official data. This drop comes shortly after President Xi Jinping urged officials to combat the downturn, which poses a threat to the growth of the world’s second-largest economy. The data reveals a 2.6 percent year-on-year decrease in fixed asset investment from January to November, exceeding the 2.3 percent decline predicted by analysts in a Bloomberg survey and worsening from a 1.7 percent fall recorded in October.

Investment Slowdown and Government Response

The continuing decline is anticipated to prompt calls from China’s leadership to “stabilise” investment, a crucial aspect of an economy historically reliant on state funding for growth, particularly in infrastructure, property, and high-end manufacturing. At the recent central economic work conference, which Xi presided over, officials stated that China would work to stabilise and revive investment, while also considering an increase in the central government budget.

Analysts interpret this as the first official recognition from China’s leadership regarding the investment slowdown. In addition, November’s retail sales growth was reported as the weakest in three years, indicating a downturn in domestic consumption and diminished household confidence, driven by a property sector slump that has now lasted for five years.

The International Monetary Fund (IMF) recently urged Beijing to implement stronger measures to stimulate domestic demand and rejuvenate its economy, which has been grappling with ongoing deflation. Analysts from Goldman Sachs estimated that approximately 60 percent of the decrease in fixed asset investment up to October stemmed from statistical corrections of previously over-reported figures. However, they noted that 40 percent of the decline could be linked to the ongoing property market issues, as well as the leadership’s efforts to manage sectors facing intense price competition and overcapacity.

Retail Sales and Industrial Production Data

The National Bureau of Statistics also disclosed that retail sales grew by only 1.3 percent in November compared to the previous year, marking the slowest growth rate since December 2022 and falling short of the 2.9 percent forecast from analysts. Additionally, industrial production rose by 4.8 percent year-on-year, which was below the anticipated 5 percent growth and lower than October’s 4.9 percent rate.

Goldman Sachs highlighted that November’s activity data largely missed market expectations, particularly regarding retail sales, and stated that fixed asset investment growth remained “depressed,” with a year-on-year decline of 10.7 percent in November alone, compared to 11.4 percent in October.

Despite these concerning figures, Goldman Sachs cautioned against overinterpreting the decline, suggesting that the statistical corrections may have played as significant a role as underlying economic factors. Unlike many major economies, China does not release comprehensive quarterly GDP breakdowns using the expenditure approach, which includes investment, consumption, and net exports. Instead, it provides monthly data series, such as fixed asset investment and retail sales, which serve as critical indicators in the absence of more detailed GDP information.

Since 2018, the National Bureau of Statistics has ceased publishing sectoral breakdowns of fixed asset investment by value, providing only growth rates across various sectors. Chinese authorities have set a growth target of approximately 5 percent for the year 2025. Recent data indicated an economic expansion of 4.8 percent in the third quarter, the slowest rate in a year. Economists remain hopeful that China can achieve its 5 percent target for this year.