Nvidia has made history by becoming the world’s first company valued at $5 trillion (approximately $7.6 trillion). This significant milestone was reached just three months after the Silicon Valley chipmaker experienced a remarkable surge in its stock price, driven largely by the increasing demand for its artificial intelligence (AI) chips. The rapid growth of Nvidia is seen as a pivotal moment in the tech industry, comparable to the launch of the first iPhone by Apple co-founder Steve Jobs 18 years ago.

The AI boom has played a crucial role in Nvidia’s ascent. The company’s stock has skyrocketed since the beginning of 2023, with shares reaching $207.86 in early morning trading on a recent Wednesday. With 24.3 billion shares outstanding, Nvidia’s market capitalization now exceeds that of entire economies, surpassing the GDP of countries such as India, Japan, and the United Kingdom, according to the International Monetary Fund.

Investment and Partnerships Fuel Growth

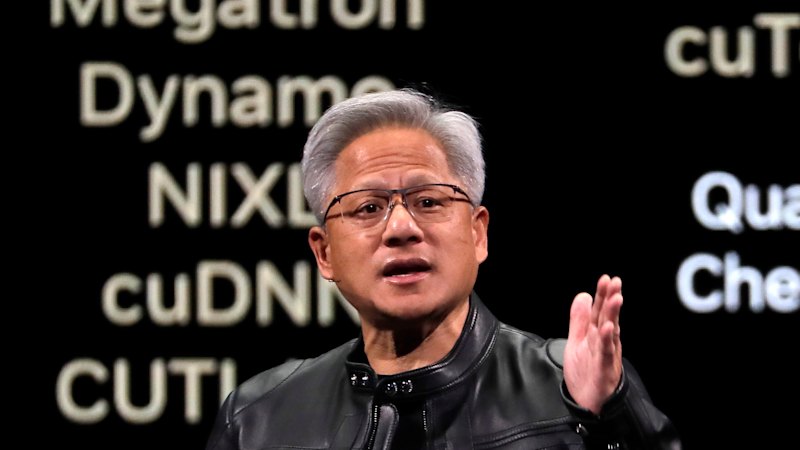

On Tuesday, Nvidia’s CEO, Jensen Huang, announced that the company has secured $500 billion in chip orders. This announcement comes alongside a series of strategic partnerships aimed at expanding Nvidia’s influence within the tech landscape. One notable collaboration is with Uber to develop robotaxis, along with a $1 billion investment in Nokia to explore 6G technology.

Additionally, Nvidia is collaborating with the U.S. Department of Energy to establish seven new AI supercomputers. Last month, the company also declared its intention to invest $100 billion in OpenAI, aiming to bolster the computing capabilities for the organization behind the popular AI chatbot ChatGPT.

Despite this unprecedented success, concerns about a potential AI bubble have emerged. Officials at the Bank of England recently warned of the risks associated with inflated tech stock prices driven by the AI boom. Similarly, the head of the International Monetary Fund has voiced caution regarding the sustainability of such rapid growth.

Future Prospects and Global Implications

Nvidia’s influence extends beyond immediate partnerships and investments. In August, Huang revealed ongoing discussions with the Trump administration regarding a new computer chip designed for China. This dialogue highlights the geopolitical dimensions of Nvidia’s operations, as President Donald Trump indicated he would address Nvidia’s chip developments with Chinese President Xi Jinping.

As Nvidia continues to navigate this transformative period, its trajectory will likely have far-reaching implications not just for the tech industry, but for global economic dynamics as well. The company’s remarkable valuation underscores the profound impact of AI technology on modern commerce and innovation.