SoftBank Group has divested its entire stake in Nvidia for approximately $5.83 billion (around $8.9 billion) as part of a strategy to finance its ambitious artificial intelligence (AI) initiatives. This move comes at a time when investors are increasingly scrutinizing the significant capital being funneled into technologies with unpredictable returns.

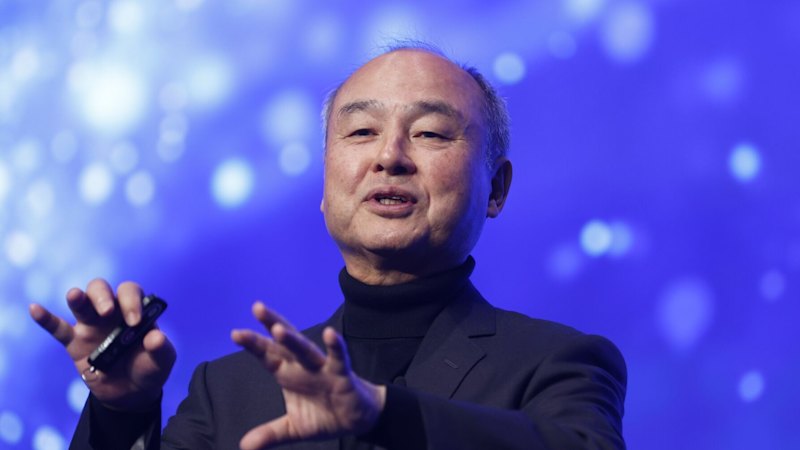

The decision to sell aligns with the vision of founder Masayoshi Son, who has been strategically unwinding various positions to support a range of AI projects, including partnerships with OpenAI and Oracle, as well as the establishment of robotic manufacturing facilities in the United States. The sale of Nvidia shares coincides with ongoing discussions regarding the potential for a tech spending bubble, particularly as companies like Meta Platforms and Alphabet are expected to invest over $1 trillion in AI over the coming years.

Following the announcement, SoftBank’s US depositary receipts surged by as much as 7.2 percent before settling at a more modest increase. In contrast, Nvidia’s stock price experienced a decline of 3.5 percent shortly after the market opened in New York on Tuesday.

SoftBank’s Strategic Decisions and Market Reactions

SoftBank’s recent actions demonstrate its commitment to becoming a significant player in the rapidly evolving AI landscape. The company plans to leverage its stakes in pivotal firms, including OpenAI and US chip designer Ampere Computing. During an earnings conference, SoftBank’s Chief Financial Officer, Yoshimitsu Goto, addressed questions regarding the possibility of an AI investment bubble, emphasizing that the sale of Nvidia shares was primarily a financing strategy rather than a reflection of concerns about Nvidia itself.

Historically, SoftBank has exited its position in Nvidia once before, in 2019. The company resumed acquiring shares in 2020, a move that proved lucrative as Nvidia’s market value surged by more than $2 trillion since then. The company reported an unexpected net income of ¥2.5 trillion (approximately $24.8 billion) for its fiscal second quarter, significantly exceeding analyst expectations.

SoftBank’s investment in OpenAI has also contributed positively to its financial performance, with the AI firm’s valuation reportedly rising by $14.6 billion since SoftBank’s initial investment. According to Kirk Boodry, a Bloomberg Intelligence analyst, SoftBank is on track for its highest annual profit since 2020, a testament to the effectiveness of its investment strategy.

Future Investments and Financial Maneuvers

The company has ambitious plans for its future, including a $1 trillion AI manufacturing hub in Arizona and the development of its Stargate data centre. SoftBank’s portfolio now includes a selection of high-profile AI entities, such as OpenAI and ByteDance, which have significantly enhanced the company’s market position. Over the three months ending in September, SoftBank’s share price experienced a remarkable 78 percent increase, marking its most substantial growth since the end of 2005.

To enhance accessibility for retail investors in Japan, SoftBank announced a 4-for-1 stock split set to take effect on January 1, 2024. This strategic move aims to broaden the company’s investor base amidst its expanding ventures in AI and technology.

SoftBank’s financing strategies are multifaceted, with plans to invest the full $22.5 billion it committed to OpenAI in December, removing earlier preconditions. The company is also in the process of acquiring Ampere Computing for $6.5 billion and has agreed to purchase ABB’s robotics division for $5.4 billion. Notably, SoftBank has expanded a margin loan based on its Arm Holdings shares to $20 billion, up from $13.5 billion, with $11.5 billion still available for use.

Research from Finimize noted that SoftBank’s stock had previously offered a “cheap” entry point for investors looking for exposure to Arm shares and a broader AI portfolio. As the market conditions evolve, the recommendation has shifted, suggesting that it may now be prudent for investors to realize their profits amid the closing of the discount gap.

SoftBank’s strategic maneuvers reflect its commitment to navigating the complexities of the AI market while positioning itself for future growth in a sector that promises both opportunity and uncertainty.