The US dollar experienced a recovery on Wednesday, rebounding by 0.3 percent against a basket of currencies, despite ongoing investor concerns regarding the independence of the US Federal Reserve. This uptick came as European stocks also showed signs of stabilization after a significant decline earlier in the week, with attention now shifting towards earnings reports from technology leader Nvidia.

Tensions surrounding the Federal Reserve intensified when a lawyer for Federal Reserve Governor Lisa Cook announced plans to file a lawsuit against former President Donald Trump for attempting to dismiss her from her position. Market analysts noted that while Cook has maintained a generally dovish stance, the prevailing rhetoric regarding the Fed’s independence raises questions about future policy decisions. Justin Onuekwusi, Chief Investment Officer at St James’s Place, emphasized that investor concern centers on the implications of a less independent central bank on inflation stability.

In terms of yields, the two-year US Treasury yield fell to its lowest level since May, reaching 3.645 percent. Conversely, the yield on the 30-year bond increased by two basis points to 4.93 percent, widening the yield curve to approximately 128 basis points, the widest since early 2022. The market has responded to comments from Fed Chair Jerome Powell made at the Jackson Hole symposium, which were interpreted as signals that interest rate cuts may be forthcoming. Currently, traders are pricing in an 84 percent chance of a rate cut at the Fed’s September meeting and expect over 100 basis points of easing by June 2026.

Investors are now closely monitoring upcoming payroll data, which will provide insight into potential rate adjustments. Ben Bennett, APAC Investment Strategist at Legal and General Investment Management, stated, “I think investors are focused more on the upcoming payroll print and what that means for a September rate move.”

European Markets Show Resilience

European shares, particularly the STOXX 600 index, edged up by 0.2 percent following a near one percent drop the previous day. The decline was influenced by French Prime Minister Francois Bayrou‘s failed attempt to garner support for his controversial debt-reduction plan, raising fears of potential government instability in France. Bayrou’s decision to call a confidence vote on September 8 has heightened concerns about the future of the euro zone’s second-largest economy.

Despite these concerns, French bonds stabilized and stock prices increased after sharp sell-offs earlier in the week. Gilles Moec, Chief Economist at AXA, noted that the critical factor is whether a budget can be secured by the end of the year. Markets currently reflect optimism reminiscent of last year when the French government successfully passed a budget, though this could change if new elections are called.

Both the euro and the British pound fell against the strengthening dollar, with the euro dipping to $1.1574, its lowest point since August 6. Meanwhile, US stock futures showed a slight increase of around 0.1 percent, as investors await Nvidia’s earnings report later today, which is expected to influence trading in US technology-focused equity indexes.

Nvidia Earnings and Global Market Implications

Nvidia, having reached a market capitalisation of over $4 trillion in July, is central to discussions about the future of artificial intelligence infrastructure and its impact on market dynamics. Following its recovery from April’s lows, the company is set to release earnings that could lead to significant fluctuations in its market value, with options traders anticipating a swing of approximately $260 billion. Investors are particularly focused on Nvidia’s performance in China, especially in light of its profit-sharing arrangement with the Trump administration and ongoing tariff negotiations between the US and China.

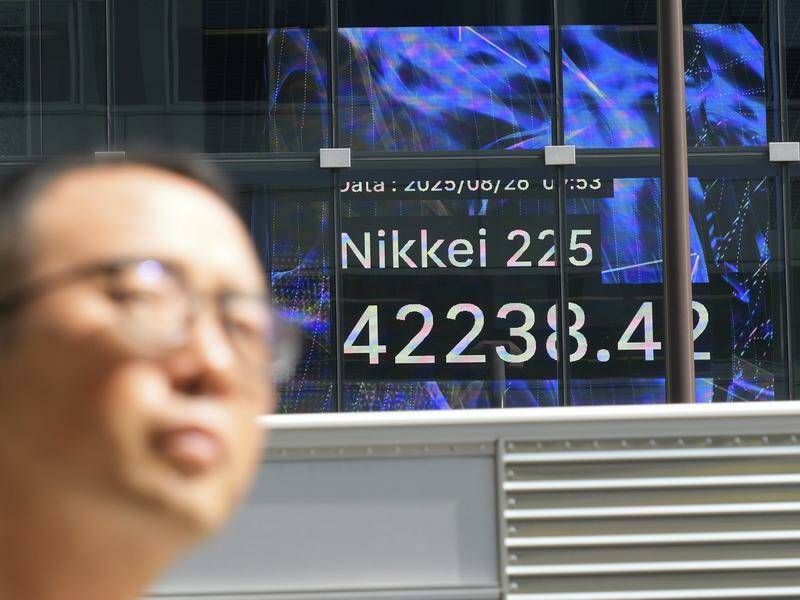

In Asian markets, Japan’s long-dated government bond yields reached historic highs following a disappointing outcome in the Bank of Japan’s latest debt purchase operations. The commodities market saw spot gold prices drop 0.5 percent after reaching a two-week high, while oil prices increased slightly amid ongoing concerns related to the conflict in Ukraine and new US tariffs on India, the world’s third-largest crude consumer. Both Brent crude and West Texas Intermediate crude futures rose by about 20 cents, trading at $67.43 and $63.47, respectively.

As the market navigates these developments, the interplay between economic indicators, geopolitical tensions, and corporate earnings will be crucial in shaping the investment landscape in the coming weeks.