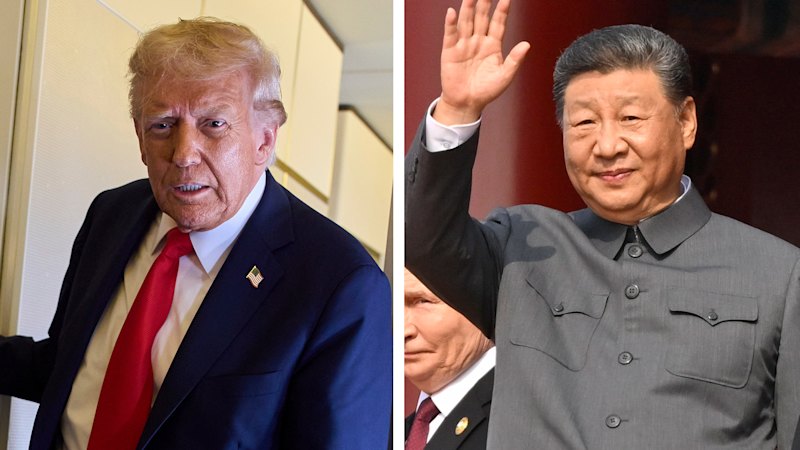

Tensions between the United States and China have escalated once again as both nations prepare for a crucial meeting at the Asia-Pacific Economic Cooperation (APEC) summit in Seoul. Following China’s announcement of new restrictions on rare earth metals, U.S. President Donald Trump quickly responded with threats of significant tariffs on Chinese imports, underscoring the fragile state of their economic relationship.

China’s Ministry of Commerce revealed last week that it would implement restrictions on rare earth elements starting on December 1. These materials are critical in the production of a wide range of technologies, including electric vehicles, smartphones, and military applications. The new measures require companies worldwide to obtain licenses for products containing even a minimal amount of these Chinese-sourced materials.

In reaction to this move, Trump announced via Truth Social that he is considering a 100 percent tariff on all Chinese imports, effective from November 1. He expressed strong disapproval, stating, “This affects ALL Countries, without exception, and was obviously a plan devised by them years ago. It is absolutely unheard of in International Trade, and a moral disgrace in dealing with other Nations.”

China’s strategic timing raises concerns as the APEC summit approaches. Initially anticipated to be a platform for Trump to showcase his “America First” trade successes, the rare earth announcement shifts the narrative in favor of Beijing. With approximately 70 percent of the world’s rare earth supply under its control, China has effectively positioned itself as a key player in this ongoing economic confrontation.

As both sides prepare for discussions, analysts are watching closely. Trump’s administration had been gearing up to impose additional controls on semiconductors and software exports. Beijing’s recent actions appear designed to counter these moves and frame the upcoming talks around its leverage in the global supply chain.

The stakes are high, particularly as the U.S. midterm elections approach. Shane Oliver, head of investor strategy at AMP, commented on Trump’s predicament, noting that pressure is mounting for him to resolve the trade issues in a way that is favorable to American voters, especially given the unpopularity of existing tariffs.

Yet, China’s maneuvering comes with its own vulnerabilities. The nation relies heavily on imported technology and components, particularly in the semiconductor and advanced manufacturing sectors. A full-scale export ban on rare earths could alienate Western markets and disrupt China’s technological advancements.

Chris McGuire, a former deputy senior director at the U.S. National Security Council, pointed out that while China believes it can exert its leverage without severe repercussions, the U.S. possesses significant countermeasures that could inflict “acute short-term pain” on the Chinese economy.

The ongoing exchanges highlight the delicate balance both nations must maintain. Each escalation risks significant repercussions, not only for their bilateral relationship but also for the global economy. Wendy Cutler, a senior vice president at the Asia Society Policy Institute, remarked on the fragile nature of the current détente between the two countries, emphasizing that both sides are testing each other’s thresholds for economic pain.

As the APEC summit approaches, the likelihood of a constructive dialogue seems increasingly uncertain. What was meant to be a diplomatic meeting now appears poised to become yet another battleground in the ongoing trade war. With both nations preparing for potential confrontation, the future of their economic relationship remains precarious.