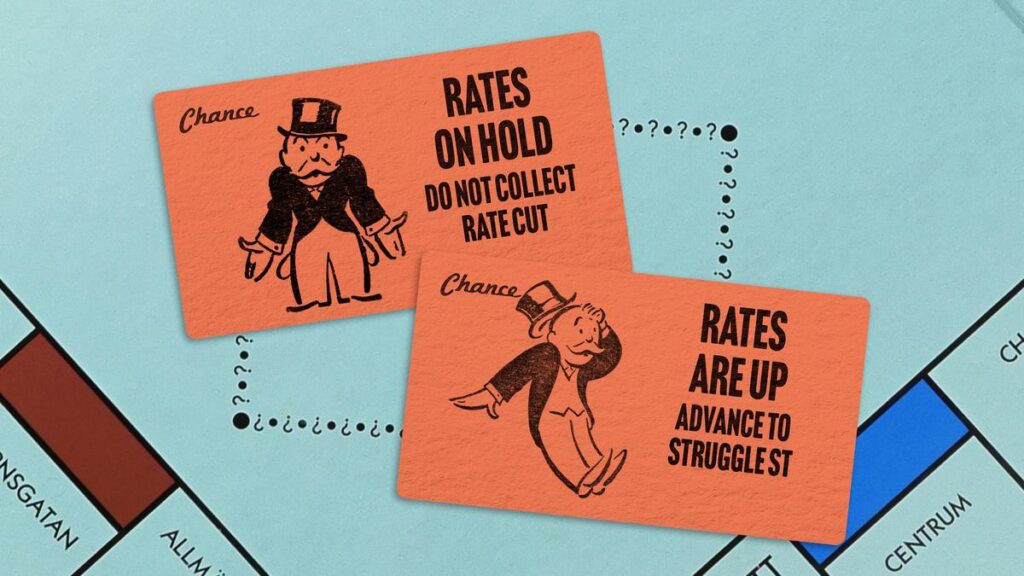

The Reserve Bank of Australia (RBA) is expected to raise interest rates as early as Tuesday, primarily due to concerns over federal government spending, according to KPMG’s chief economist, Brendan Rynne. With financial markets predicting a 72 percent likelihood of a quarter-point increase, all four major banks anticipate a reversal of the rate cut made in August.

Rynne argues that high levels of government expenditure, particularly on the National Disability Insurance Scheme (NDIS) and taxpayer-subsidised jobs, are contributing to inflationary pressures. “Yes, I do think so,” he stated during an interview with The Nightly. “The high level of spending that is going towards government services needs to be curtailed to help with the underlying price pressures.”

The economist expressed skepticism regarding Treasurer Jim Chalmers‘ claim that government spending is decreasing while businesses drive inflation. “I would suggest the data doesn’t marry with that story,” Rynne added, emphasizing a disconnect between Chalmers’ narrative and the available economic data.

Treasurer Chalmers has indicated that government spending is being reduced following a rise in headline inflation to 3.8 percent at the end of last year, up from 3.4 percent in November. This comes amid a report from the opposition, backed by independent economist Chris Richardson, predicting a $57 billion budget deficit by 2036 when comparing the latest economic outlook to earlier forecasts made prior to the May election.

Expectations for Rate Hikes and Economic Implications

With potential rate hikes looming, the Australian dollar recently reached 71 US cents for the first time in three years. A sustained higher currency could alleviate inflationary pressures if it remains above 70 US cents for several months, coupled with a decrease in import costs.

Most economists expect the RBA to raise rates, although a minority believe the current rate of 3.6 percent may hold steady. Monthly moderation in housing and services sector costs has prompted Phil O’Donoghue, chief economist at Deutsche Bank, to suggest that underlying inflation, currently at 3.3 percent, could return to the RBA’s target range by August. “There is a notable deceleration in the last two months of last year,” he remarked, urging the RBA to hold off on immediate hikes.

Despite low unemployment, which fell to 4.1 percent in December from 4.3 percent in November, analysts caution against tightening monetary policy too soon. A report released by ANZ indicates that while job advertisements increased by 4.4 percent in January, this figure is 3.2 percent lower than the same time last year, suggesting a softening in employment growth.

Market Reactions and Future Predictions

Analysts from Morgan Stanley are among those predicting that the RBA may choose to maintain current rates. They anticipate a closely debated decision that will hinge on continued slowing in demand and inflation trends. The expectation is that the RBA will keep future hikes on the table while considering the potential for an extended hold.

In the housing market, national prices experienced a substantial annual increase of 10.2 percent as of January 31, 2024. However, Tim Lawless, research director at Cotality, believes this growth will moderate as immigration rates decline. “The ‘catch up’ phase of population growth has moderated back toward longer-run averages,” Lawless noted, suggesting that while housing demand remains positive, the extreme pressures may ease.

As the RBA prepares for its decision, the implications of federal spending and broader economic trends will play a crucial role in shaping Australia’s financial landscape in the coming months.