UPDATE: As uncertainty grips the market, investors are urged to tighten their focus on resilient stocks, according to investment expert Scott Phillips from Motley Fool Australia. With economic slowdowns and geopolitical tensions escalating, it’s crucial to identify stocks that can withstand turbulent times.

Phillips highlights the importance of investing in companies that meet everyday needs, such as CSL Ltd (ASX: CSL) and Woolworths Group Ltd (ASX: WOW). These businesses demonstrate resilience as demand for their products remains steady, even in challenging economic conditions. “Spending patterns may shift, but essential services are always needed,” Phillips stated.

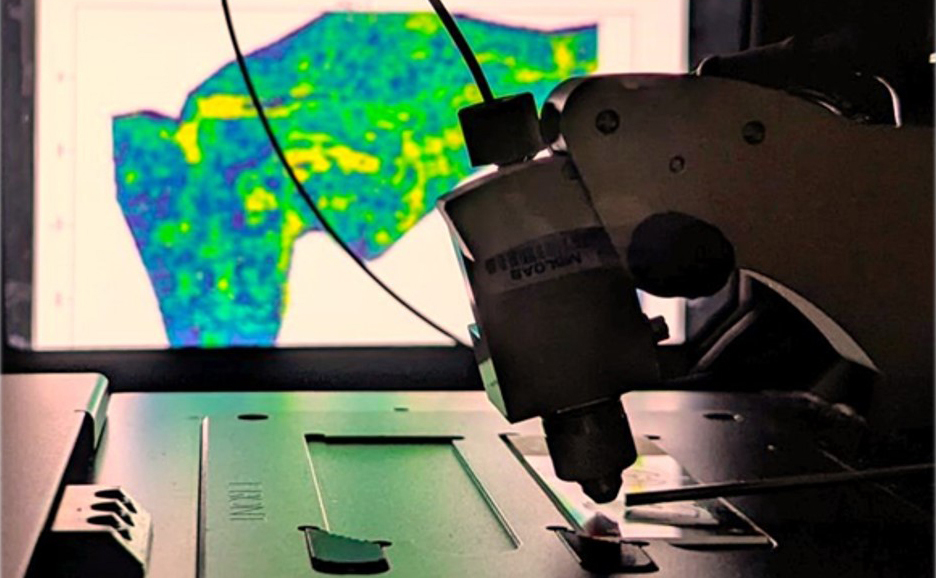

Investors need to pay attention to companies with strong balance sheets during these volatile periods. Phillips emphasizes that businesses generating consistent cash flow and maintaining manageable debt levels are better positioned to navigate uncertainty. An example he cites is Pro Medicus Ltd (ASX: PME), known for its stable revenue streams.

“Strong balance sheets don’t just reduce risk; they enable growth opportunities when competitors may falter,” Phillips added. This approach is vital as investors seek stability in their portfolios.

Leadership plays a pivotal role in guiding companies through turbulent times. Phillips advises looking for management teams that prioritize long-term strategy over short-term fixes. “Disciplined leadership instills confidence that the company can weather storms without sacrificing future growth,” he explained.

Competitive advantages are also essential in uncertain markets. Companies with scale, regulatory protections, or unique market positions are likely to thrive, even as conditions change. Phillips urges investors to be cautious of companies reliant on favorable market conditions for their success.

In conclusion, Phillips asserts that uncertain times demand discipline rather than hasty decisions. By focusing on essential businesses, financial strength, and durable competitive advantages, investors can position themselves to stay invested when it matters most.

As the market continues to evolve, it is critical for investors to remain informed and proactive. For those considering investments, Phillips suggests evaluating potential stocks carefully to identify those that align with these key principles.

The latest insights from Motley Fool emphasize that the time to act is now, as navigating uncertainty can lead to advantageous long-term investments.

For further updates, stay tuned to Motley Fool Australia as they continue to monitor the market landscape and provide expert guidance.