URGENT UPDATE: Nvidia, once valued at a staggering $6 trillion, is facing a dramatic stock downturn as 2026 unfolds. Shares have plummeted nearly 8 percent since reaching an all-time high on October 29, spurring fears about the sustainability of artificial intelligence spending and the company’s market dominance.

This sharp decline has resulted in a staggering loss of $460 billion in market value in just a few months, reducing Nvidia’s capitalization to approximately $4.6 trillion. Despite a remarkable 1,200 percent gain over the past three years, the current trajectory raises urgent questions for investors. As of midday Tuesday in New York, Nvidia’s shares were up 0.7 percent, but the market is on edge.

The chipmaker, based in Santa Clara, California, is grappling with intensified competition from rivals like Advanced Micro Devices and even its major clients, including Alphabet and Amazon. Analysts are increasingly concerned that Nvidia’s investments in these companies might be artificially inflating demand.

“The risks have clearly risen,” stated JoAnne Feeney, partner and portfolio manager at Advisors Capital Management, which manages $13 billion in assets. Wall Street’s anxiety is palpable, as Nvidia’s stock has been a significant driver of the S&P 500, contributing roughly 16 percent to its advance since October 2022.

Despite these pressures, Nvidia is projected to experience 57 percent profit growth and a 53 percent increase in sales in its next fiscal year, which ends on January 31, 2027. The firm’s performance is still expected to outshine competitors, with an average price target suggesting a potential 37 percent gain over the next 12 months.

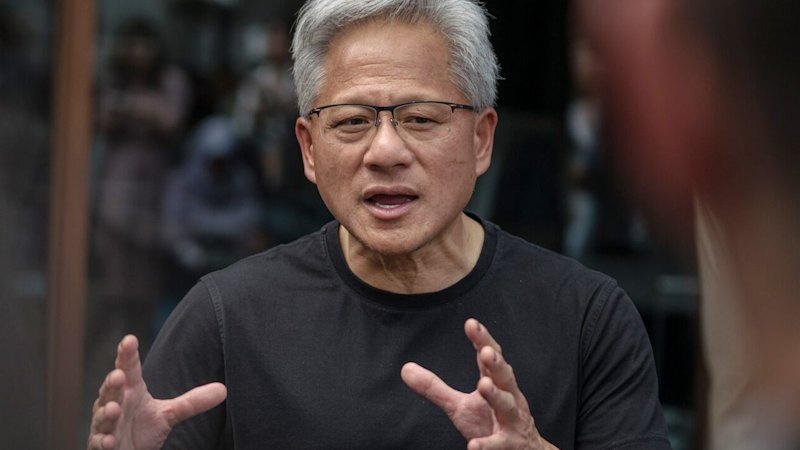

Nvidia’s CEO, Jensen Huang, announced at the CES trade show in Las Vegas that demand for Nvidia GPUs is “skyrocketing,” driven by increasing model complexities. However, the company must navigate a rapidly changing landscape.

Competitors are gaining ground, with Advanced Micro Devices poised to increase its data centre revenue by nearly 60 percent to almost $26 billion in 2026. Major players like Alphabet and Amazon are also developing their own chips to cut costs, posing a significant challenge to Nvidia’s market share, which currently stands at over 90 percent.

The impact of a downturn in Nvidia’s stock would resonate across the equity market. Investors are closely monitoring Nvidia’s profit margins, particularly as rising competition pressures pricing. The company’s gross margin, a key profitability metric, is expected to dip to 71.2 percent in fiscal 2026, raising alarms if it continues to decline.

Despite the challenges, Nvidia’s stock remains relatively undervalued compared to its peers. Analysts assert that the market may be underestimating Nvidia’s position. Vivek Arya, a semiconductor analyst at Bank of America, emphasized, “That is the opportunity from an investor perspective.”

Nvidia is set to release its next-generation chips, dubbed Rubin, later this year, which could further influence demand. As the landscape for AI technology evolves, investors and consumers alike are watching closely to see how Nvidia adapts and maintains its foothold in this competitive market.

In summary, Nvidia’s current stock situation underscores a pivotal moment for the tech giant as it navigates substantial challenges and opportunities in 2026. Investors should stay alert for further developments as the situation unfolds.